Driving Automotive Development

SBICAPS delivers end-to-end fundraising, advisory, and service capabilities for the Automotive and Auto ancillary sector and its subsectors.

SBI Capital Markets enables clients to meet their strategic and business objectives through its complete bouquet of investment banking and corporate advisory services.

SBICAPS is now ISO 27001:2022 certified! This milestone is a testament to our dedication to maintaining the highest standards of...

16 Apr 2025

Read more

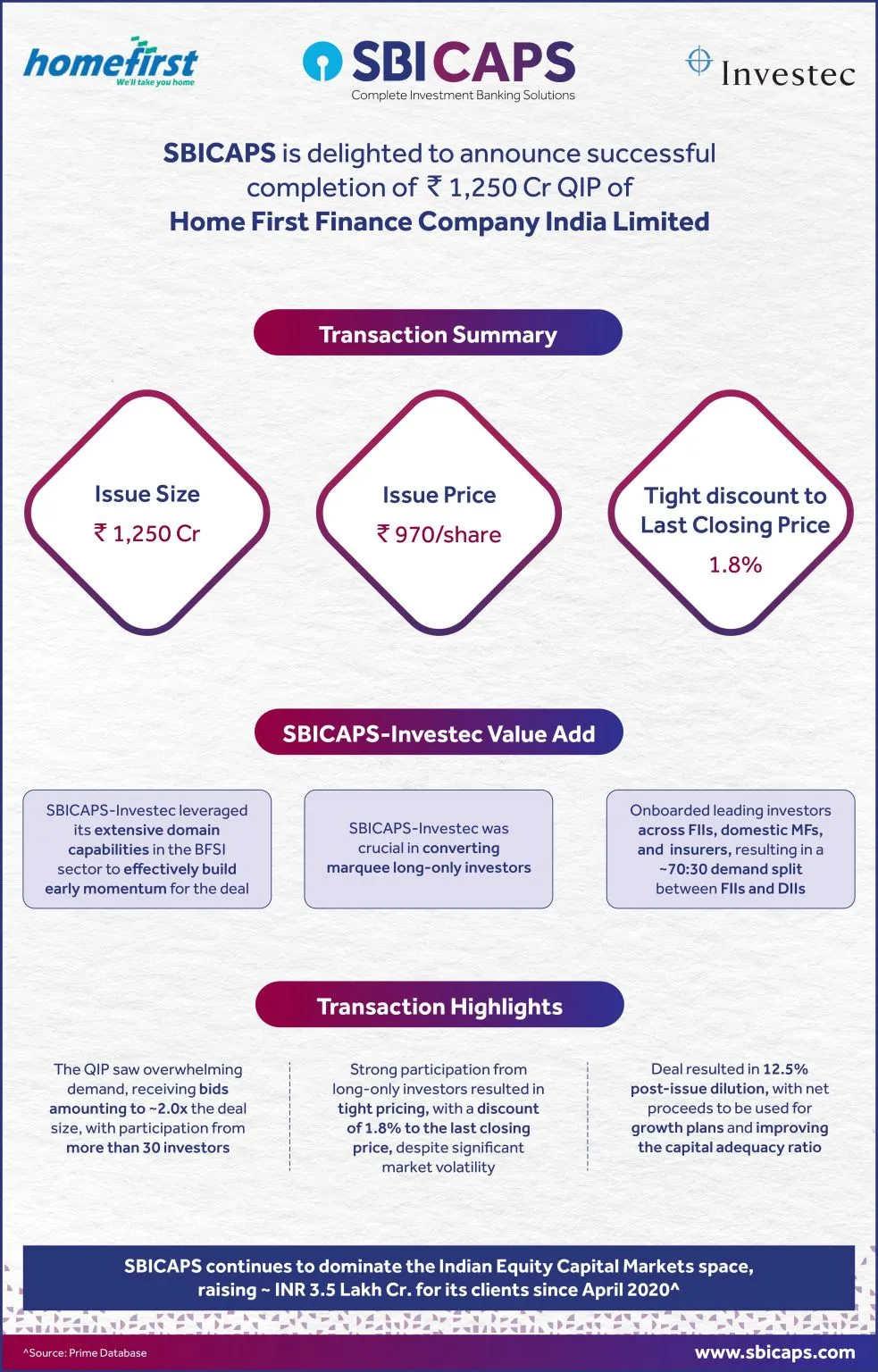

SBICAPS is delighted to announce successful completion of ₹ 1,250 Cr QIP of Home First Finance Company India Limited

15 Apr 2025

Read more

On World Health Day, SBICAPS is committed to making a difference in communities across the country, ensuring better health and...

07 Apr 2025

Read more

SBICAPS is proud to have acted as a Transaction Advisor and Left Lead Merchant Banker to NHIT’s ‘Round-4’ unit issuance –...

03 Apr 2025

Read more

SBICAPS donated a 43-seater school bus to Amcha Ghar English High School and Junior College in Uttan, as part of...

03 Apr 2025

Read more

SBICAPS wishes all clients, stakeholders and well wishers a happy festive season!

31 Mar 2025

Read more

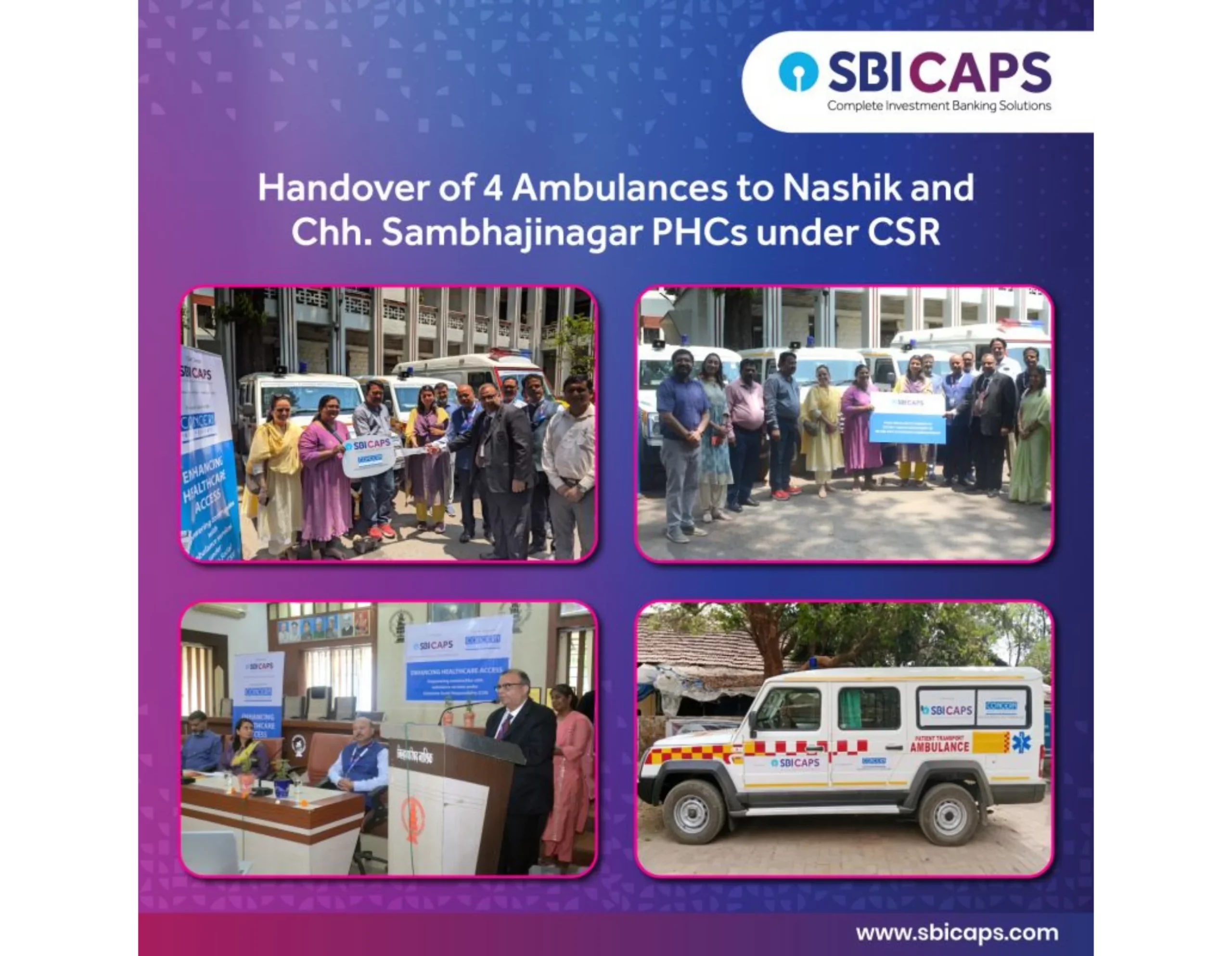

SBICAPS, in partnership with Concern India Foundation, has donated 5 Type B Trax ambulances to Primary Health Centers (PHCs) in...

29 Mar 2025

Read more

SBICAPS is delighted to welcome Shri. Amrendra Singh as SVP & Group Head, Equity Capital Markets

22 Mar 2025

Read more

SBICAPS distributed utensil kits and household solar lights to 550 needy tribal households of Kharabachiwadi, Garbhat, Vitthalwadi, Dongarwadi and Madhali...

22 Mar 2025

Read more

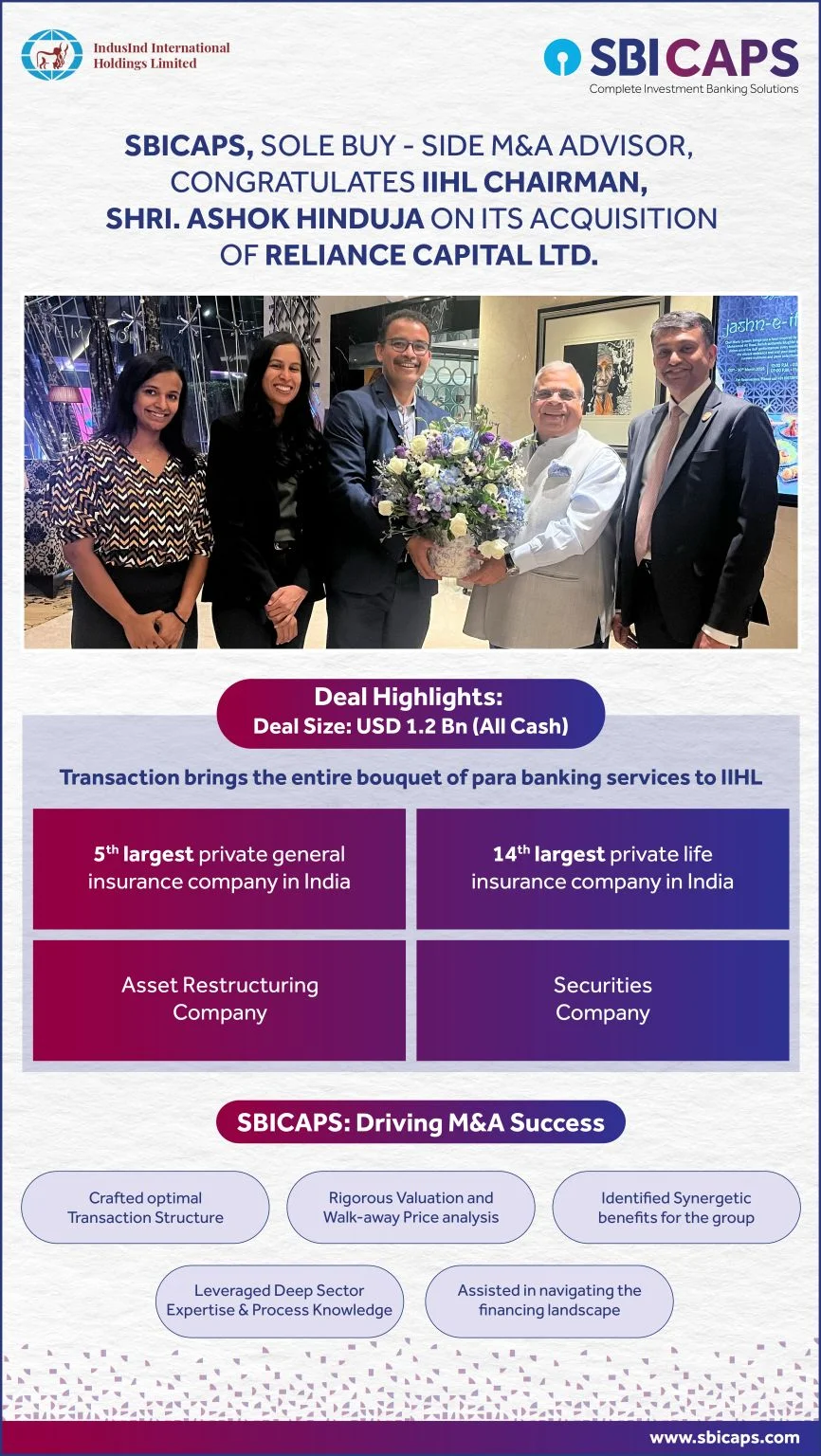

IndusInd International Holdings Ltd has successfully acquired Reliance Capital Ltd under Corporate Insolvency Resolution Process. SBICAPS acted as the sole...

20 Mar 2025

Read more

SBICAPS is proud to be associated with the stellar success of AJAX Engineering Limited's (Ajax) IPO of ₹1,269 cr. To...

11 Mar 2025

Read more

This week, SBICAPS celebrated its incredible women workforce with a series of exciting events. The week kicked off with thrilling...

08 Mar 2025

Read more

SBICAPS has established a new geriatric care unit in Varanasi, Uttar Pradesh, to provide healthcare for underprivileged seniors. This also...

06 Mar 2025

Read more

SBICAPS is delighted to act as Transaction Advisor to PTC India Limited (“PTC”) for 100% Stake sale of PTC Energy...

05 Mar 2025

Read more

SBI Capital Markets Limited is proud to share that Mr. Pratin Sharma, Assistant Vice President, was one of the distinguished...

27 Feb 2025

Read more

As part of its CSR initiatives, SBICAPS has supported the installation of a solar power system at the Government-run Civil...

21 Feb 2025

Read more

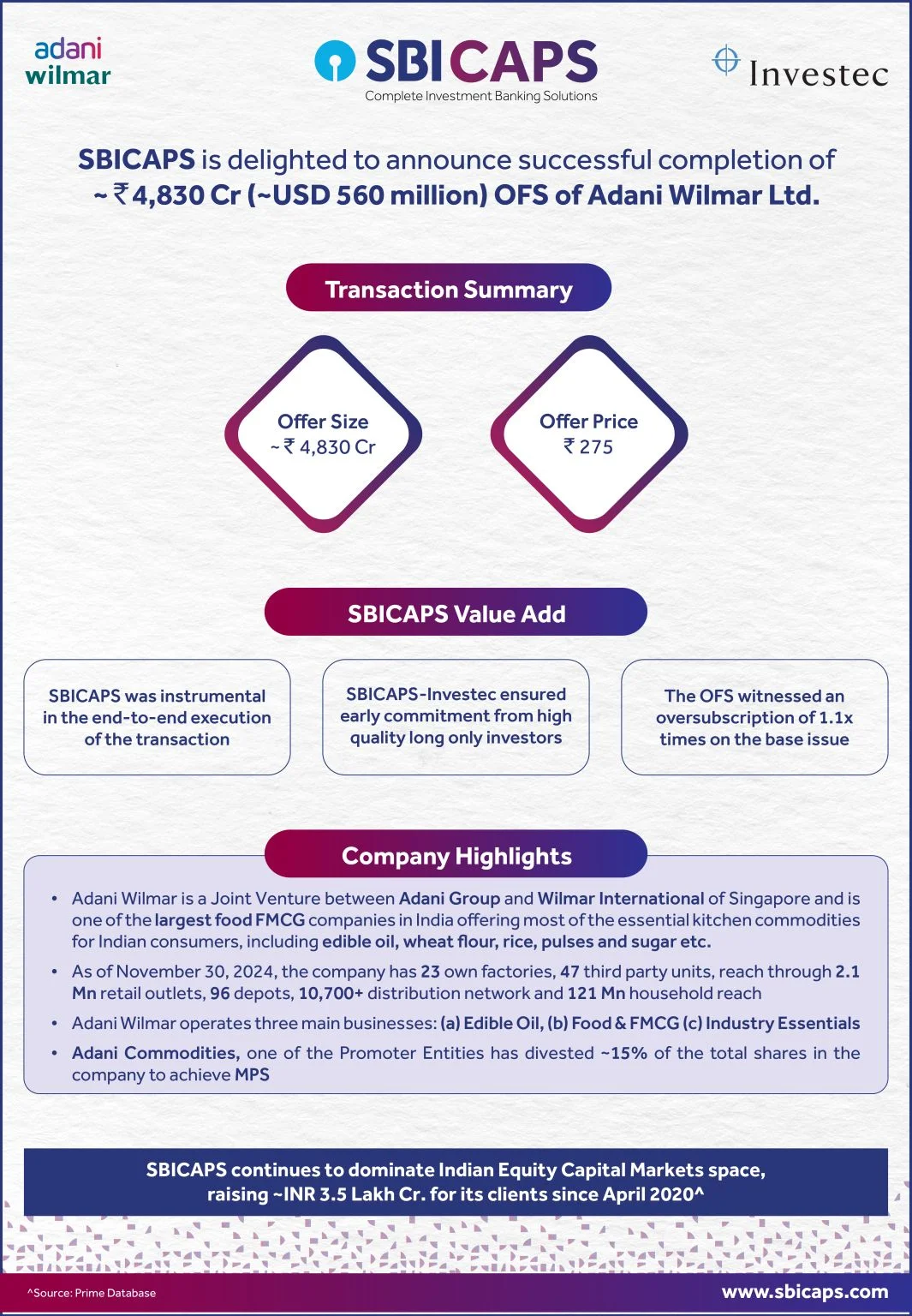

SBICAPS is delighted to announce successful completion of ₹ 4,830 Cr OFS of Adani Wilmar Limited To know more about...

05 Feb 2025

Read more

This Republic Day, we partnered with Umang Foundation to host a blood donation drive at our Mumbai office on Friday,...

25 Jan 2025

Read more

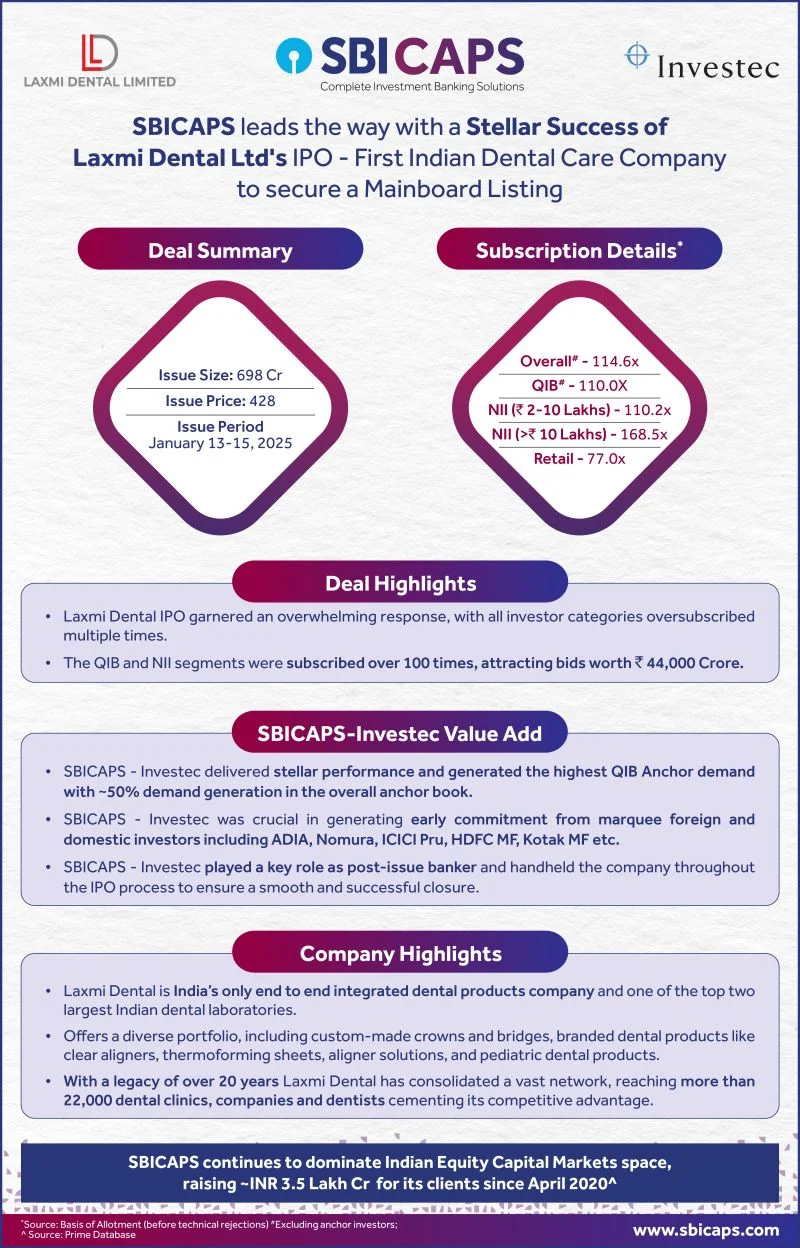

SBICAPS leads the way as a Bookrunner, in the successful completion of the IPO of Laxmi Dental Limited

22 Jan 2025

Read more

We are thrilled to announce the successful Financial Closure for BPCL’s Bina Petrochemical cum Refinery Expansion Project, a strategic initiative...

22 Jan 2025

Read more

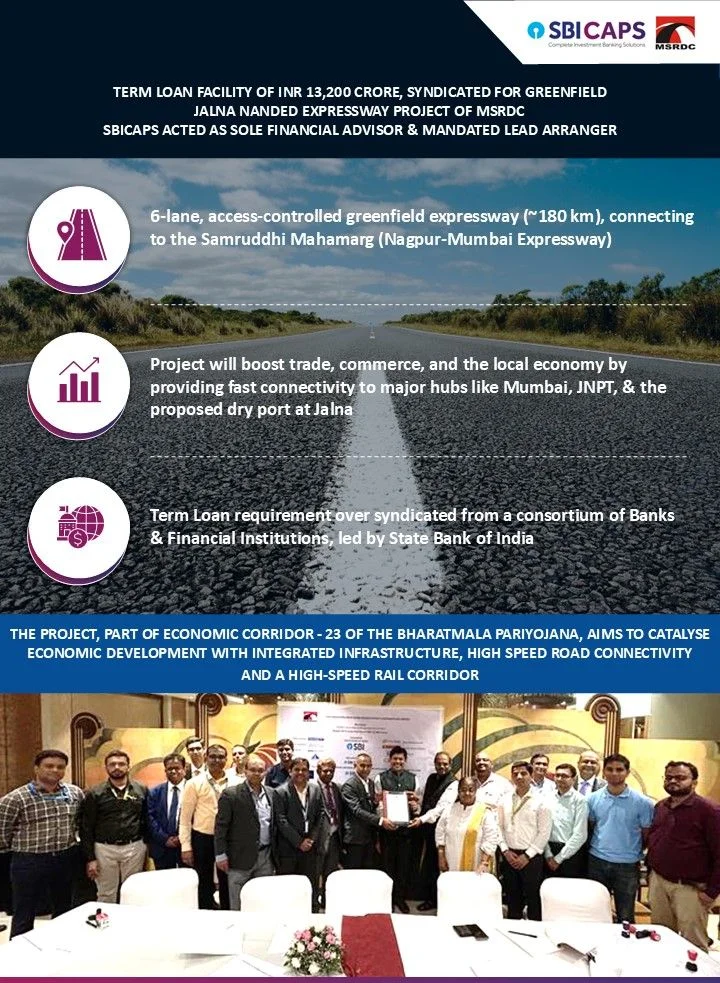

SBICAPS is proud to have served as the Sole Financial Advisor & Mandated Lead Arranger for the greenfield Jalna Nanded...

20 Jan 2025

Read more

SBICAPS is delighted to act as the Left Lead BRLM for the sucessful public issue of Capital Infra Trust (erstwhile...

20 Jan 2025

Read more

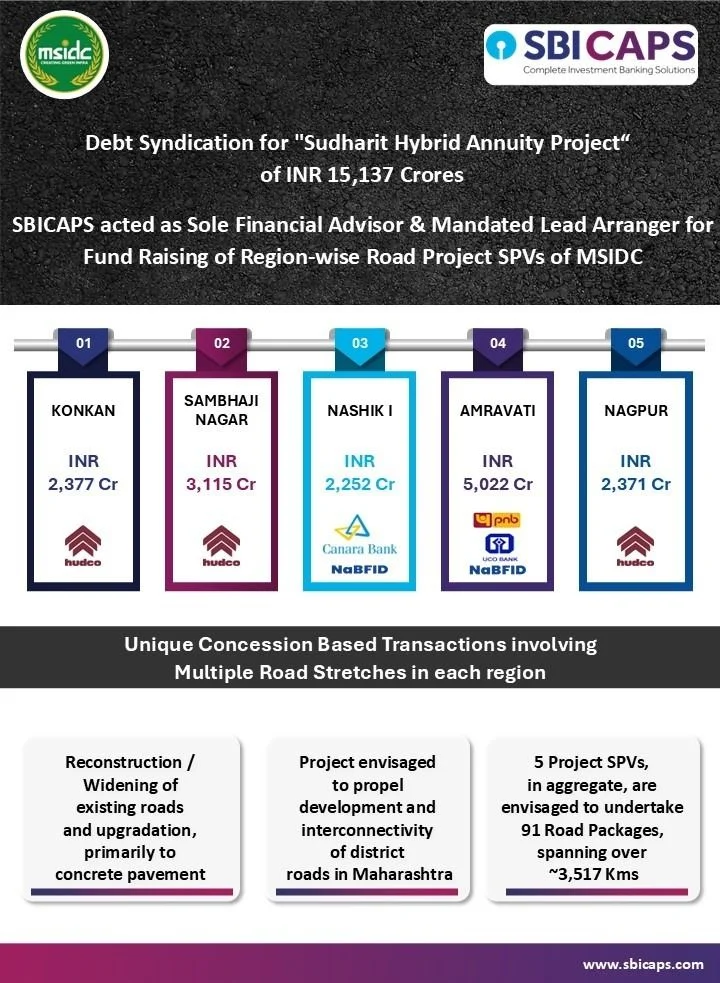

SBICAPS has successfully acted as the Sole Financial Advisor & Mandated Lead Arranger for the 5 project SPVs of MSIDC,...

10 Jan 2025

Read more

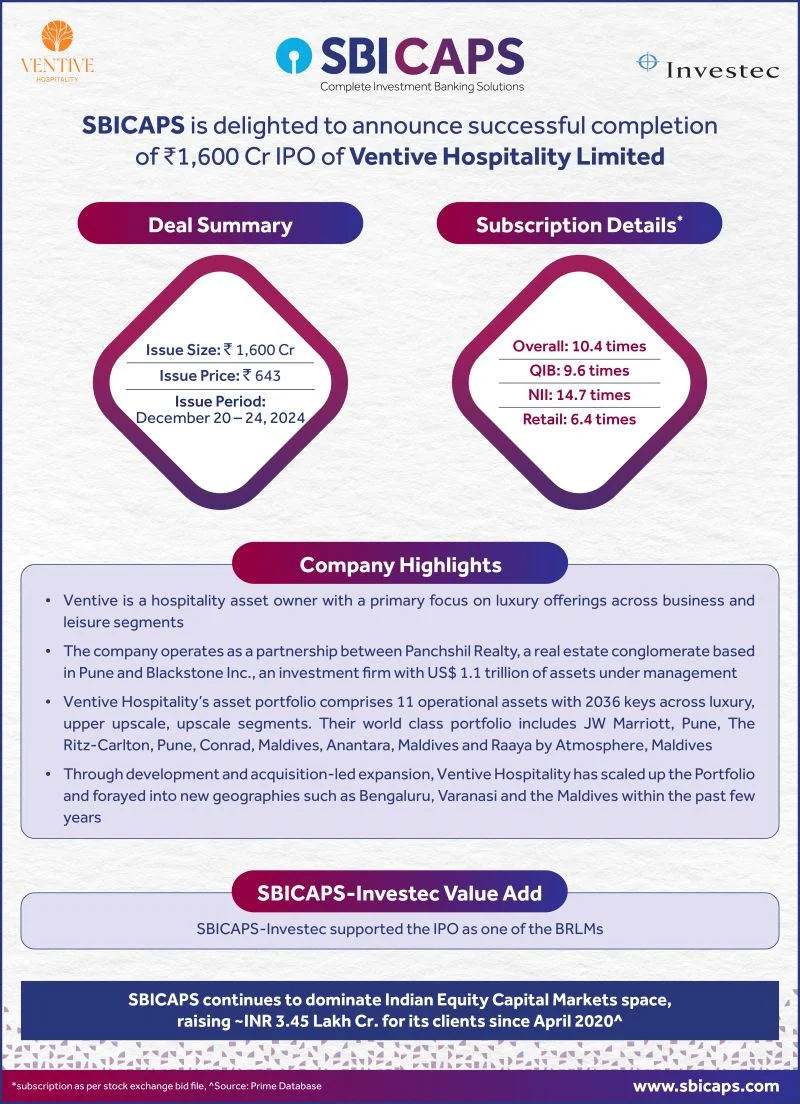

SBICAPS is delighted to announce successful completion of ₹ 1,600 Cr IPO of Ventive Hospitality Limited.

10 Jan 2025

Read more

03 Jan 2025

Read more

On the auspicious occasion of Diwali, the festival of lights, SBICAPS extends its warm greetings to all our clients, associates,...

01 Nov 2024

Read more

SBICAPS office was filled with joy and a sense of community this Diwali. Our annual Diwali Mela showcased innovative stalls...

31 Oct 2024

Read more

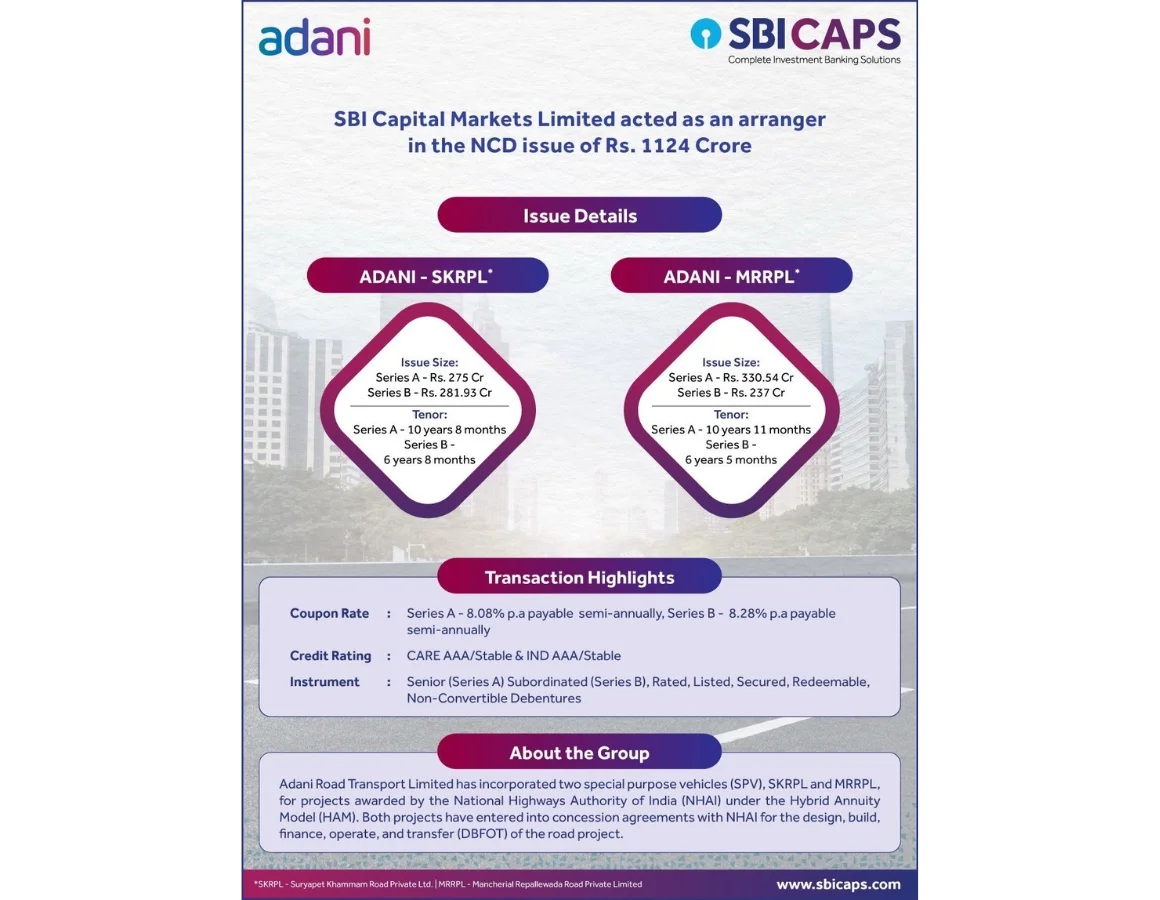

We are proud to announce that two special purpose vehicles of Adani Road Transport Limited i.e., Suryapet Khammam Road Private...

29 Oct 2024

Read more

The Central Vigilance Commission observes “Vigilance Awareness Week” every year in the week, in which the birthday of Sardar Vallabhbhai...

29 Oct 2024

Read more

Shri Virendra Bansal - MD & CEO, SBICAPS is representing the company at SIBOS 2024, which is attended by participants...

24 Oct 2024

Read more

SBICAPS has setup bio compost units in Nashik under its CSR initiative called Project Samriddhi. In collaboration with our non-profit...

23 Oct 2024

Read more

SBICAPS is proud to be associated with Druk Green Power Corporation Limited for structuring Bhutan’s first Hydropower Receivables Securitization Loan....

18 Oct 2024

Read more

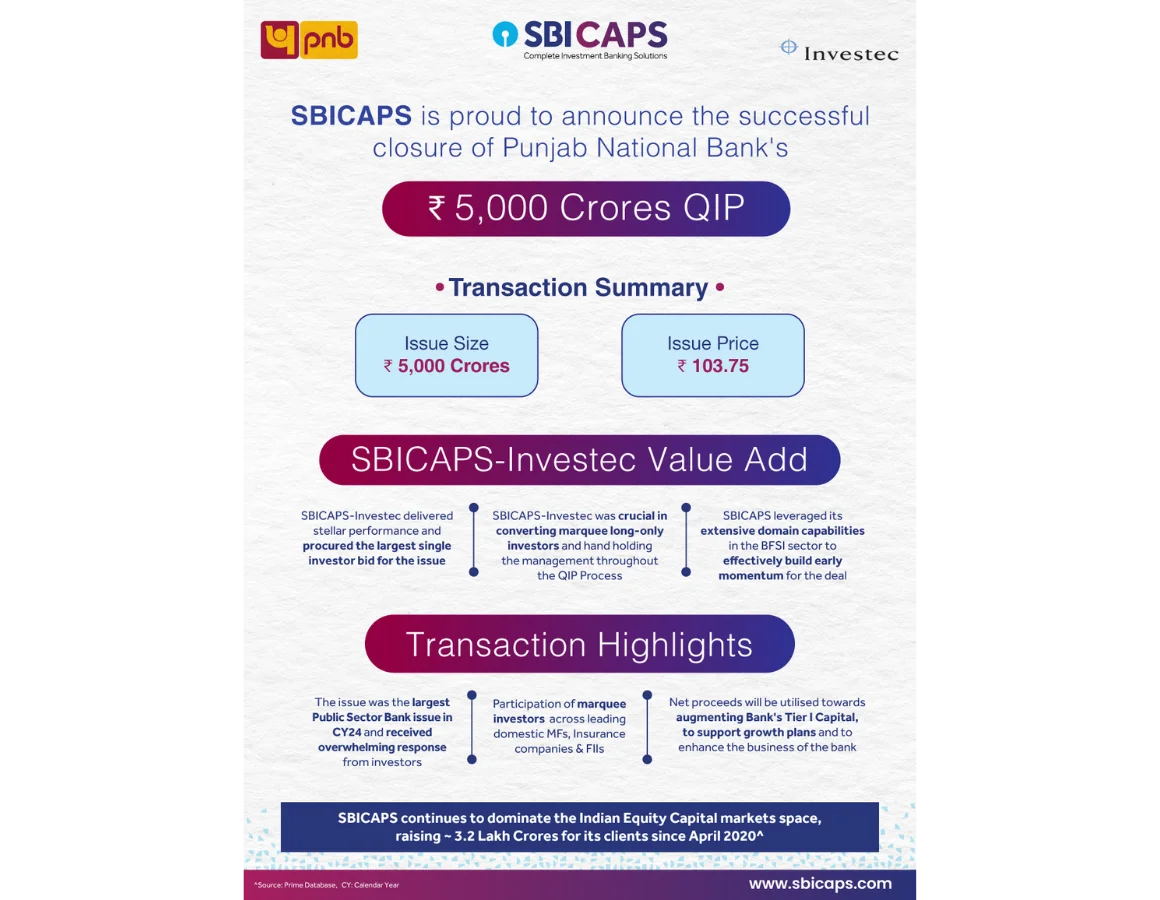

SBICAPS leads the way as a bookrunner, in the blockbuster success of ₹5,000 Cr QIP of Punjab National Bank, the...

04 Oct 2024

Read more

STEM education is crucial in today’s rapidly evolving world. It not only fosters critical thinking and problem-solving skills but also...

01 Oct 2024

Read more

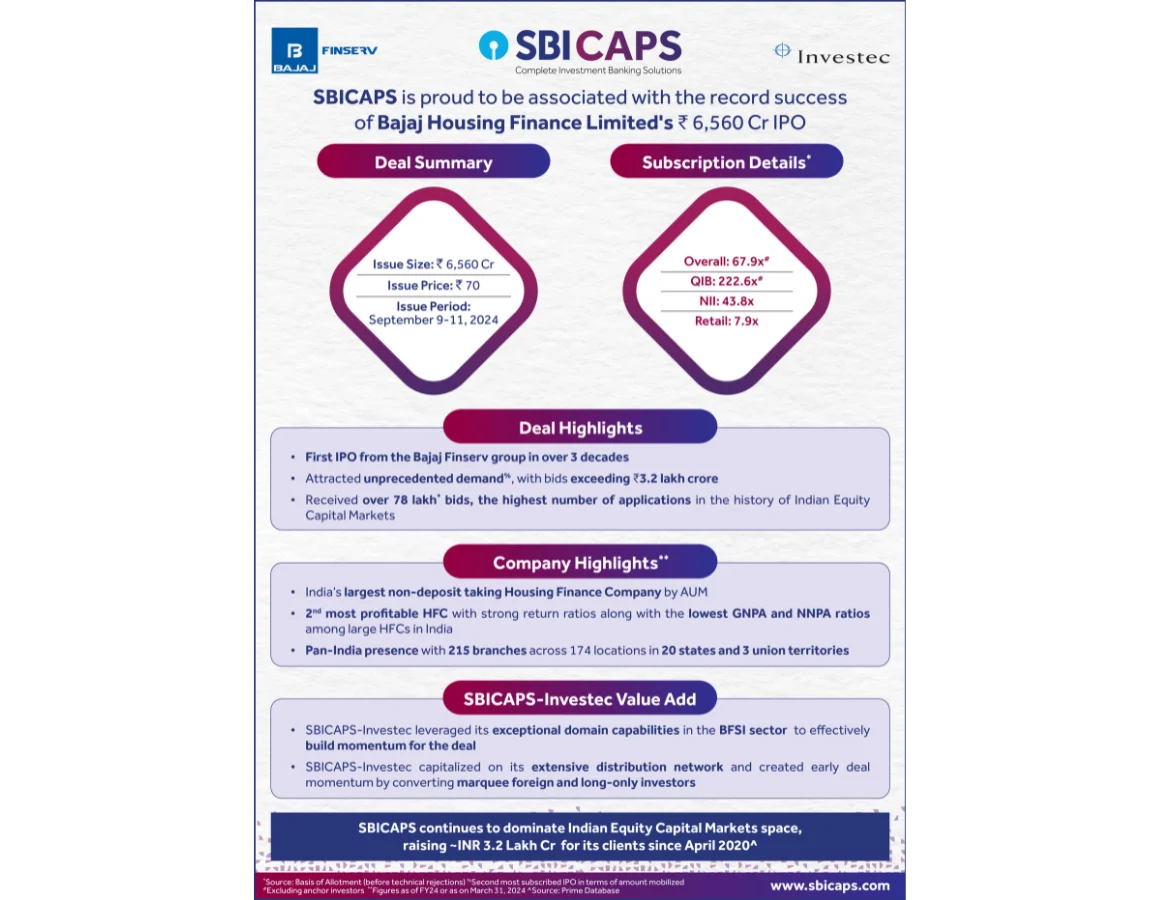

SBICAPS is proud to be associated with the record success of Bajaj Housing Finance Limited’s ₹ 6,560 Cr IPO –...

16 Sep 2024

Read more

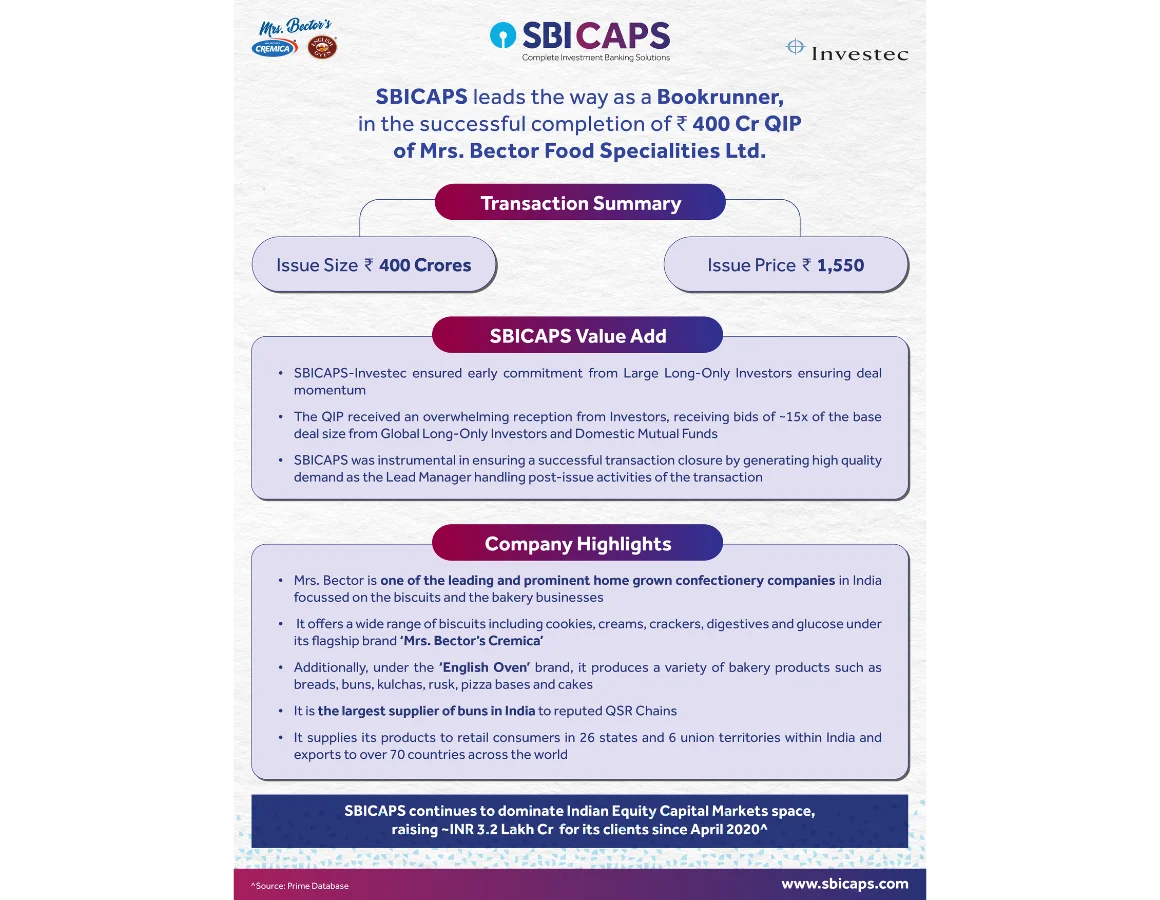

SBICAPS leads the way as a Bookrunner, in the successful completion of ₹400 Cr QIP of Mrs. Bector Food Specialities...

13 Sep 2024

Read more

It has been a stellar year for the equity capital markets and SBICAPS has been at the forefront in assisting...

03 Sep 2024

Read more

SBICAPS welcomes Shri Challa Sreenivasulu Setty as the new Chairman of State Bank of India & wishes him the very...

31 Aug 2024

Read more

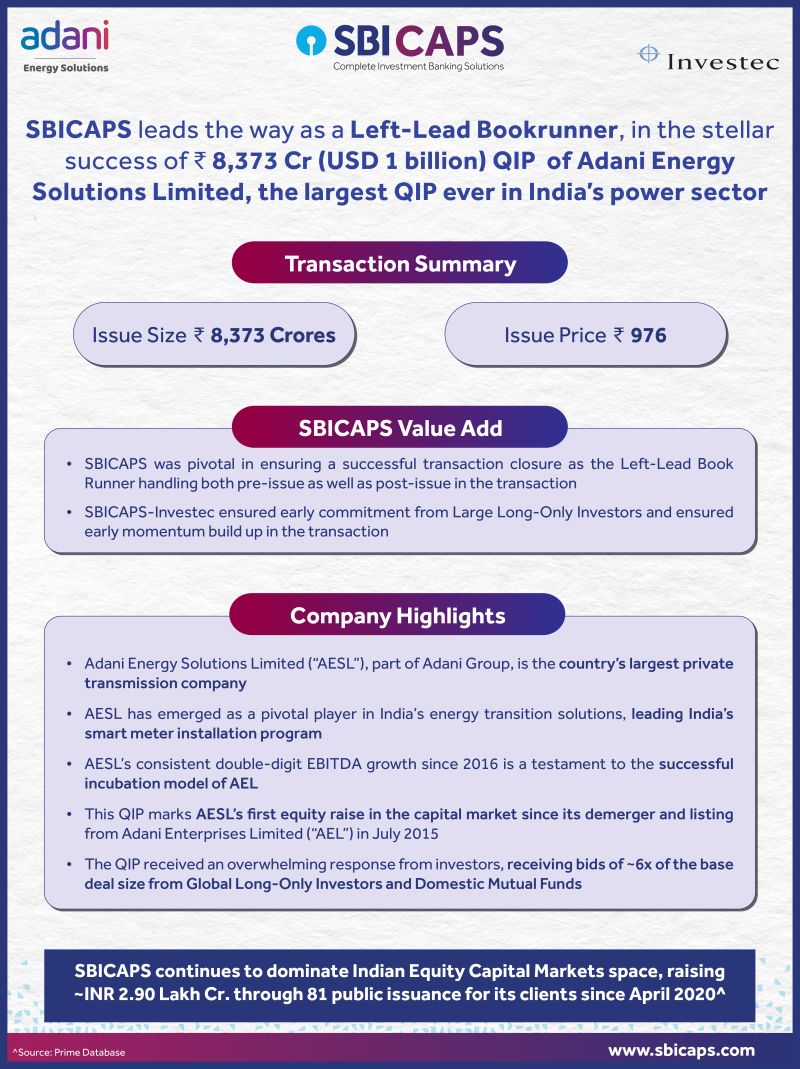

SBICAPS leads the way as a Left-Lead Bookrunner, in the stellar success of ₹8,373 Cr (USD 1 billion) QIP of...

28 Aug 2024

Read more

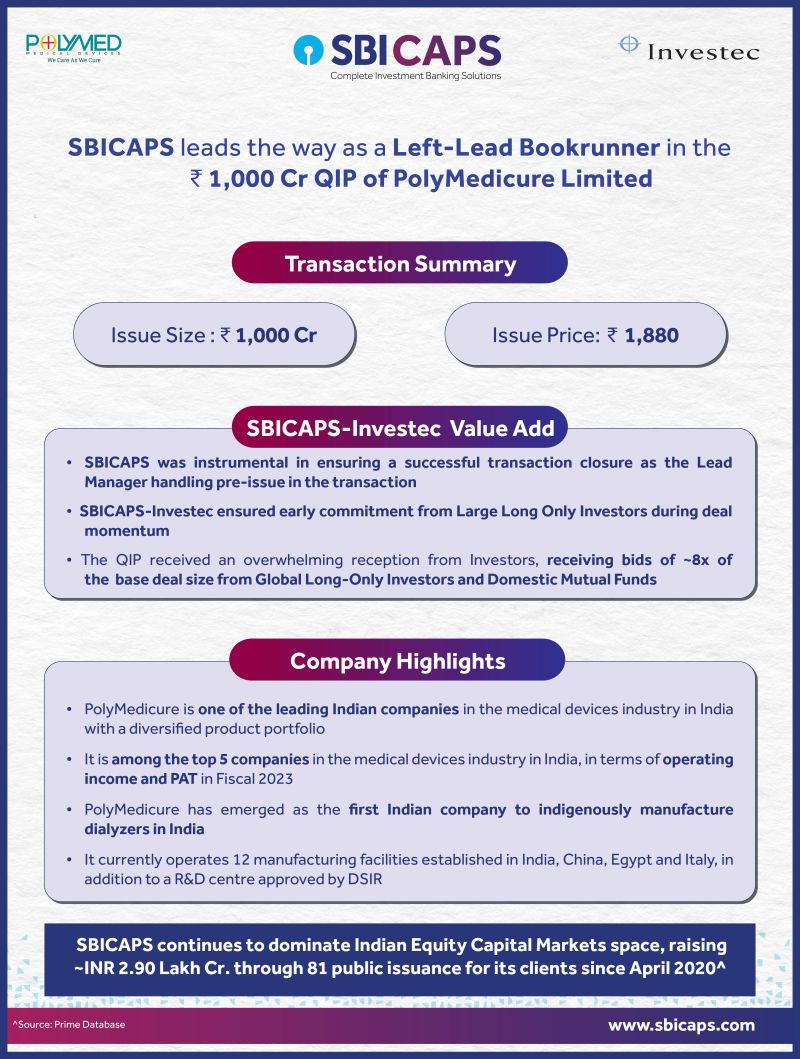

SBICAPS leads the way as a Left Lead Bookrunner in the ₹1,000 cr QIP of Poly Medicure Ltd To know...

28 Aug 2024

Read more

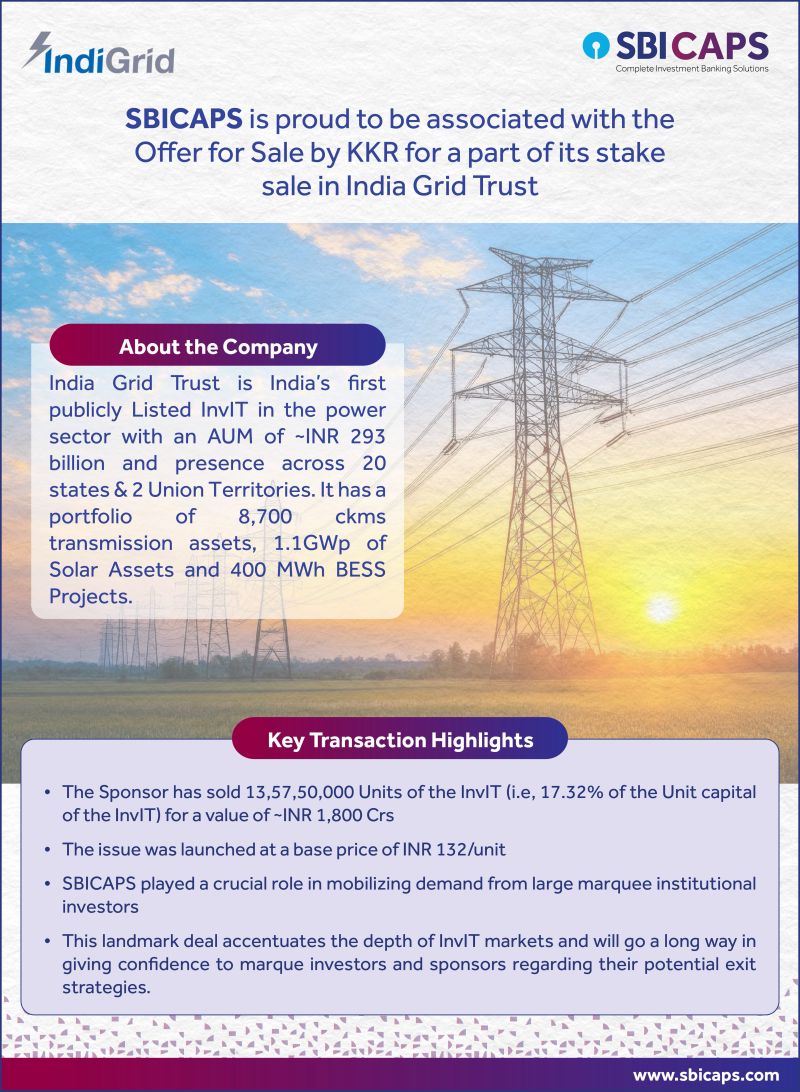

SBICAPS is proud to be associated with the Offer for Sale by KKR for a part of its stake sale...

28 Aug 2024

Read more

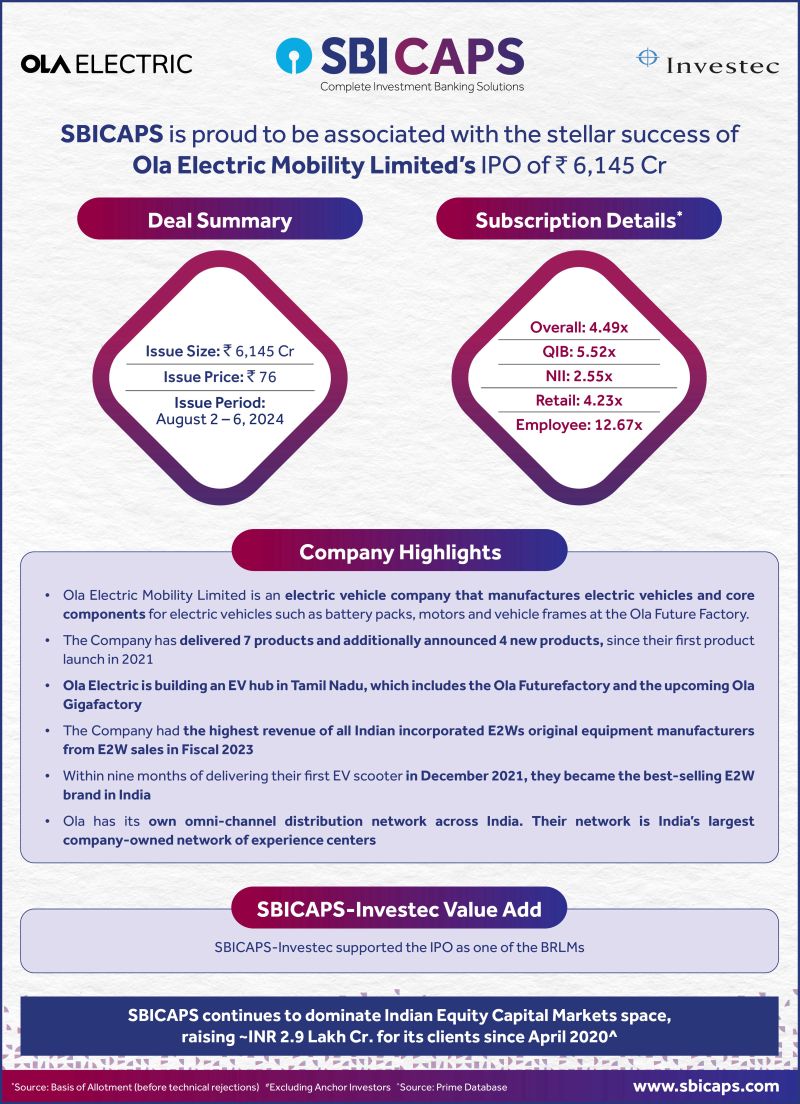

SBICAPS is proud to be associated with the stellar success of Ola Electric ‘s IPO

26 Aug 2024

Read more

SBICAPS has supported paediatric cataract surgeries and donated equipment to a charitable hospital in partnership with Nav Bharat Jagriti Kendra...

21 Aug 2024

Read more

The 21st Annual Capital Markets Conference (CAPAM) of FICCI was recently conducted with the theme ‘Capital Market Reforms 2.0 for...

07 Aug 2024

Read more

Our 38th Foundation Day signifies a remarkable legacy of leadership, passion, and innovation. We thank our valued clients and partners...

01 Aug 2024

Read more

SBICAPS leads the way with a Blockbuster IPO of Bansal Wire Industries Limited as a Left Lead Bookrunner

12 Jul 2024

Read more

SBI Capital Markets Limited acted as the Sole Financial Advisor to IAV Utkarsh Limited for raising of funds in the...

10 Jul 2024

Read more

Today marks a special milestone as we celebrate one year since moving into our state-of-the-art Corporate Office in BKC. This...

19 Jun 2024

Read more

In the latest episode of SBICAPS Expert Speak, Mr. Rajan Gupta- Executive Vice President and Group Head- Project Advisory and...

14 Jun 2024

Read more

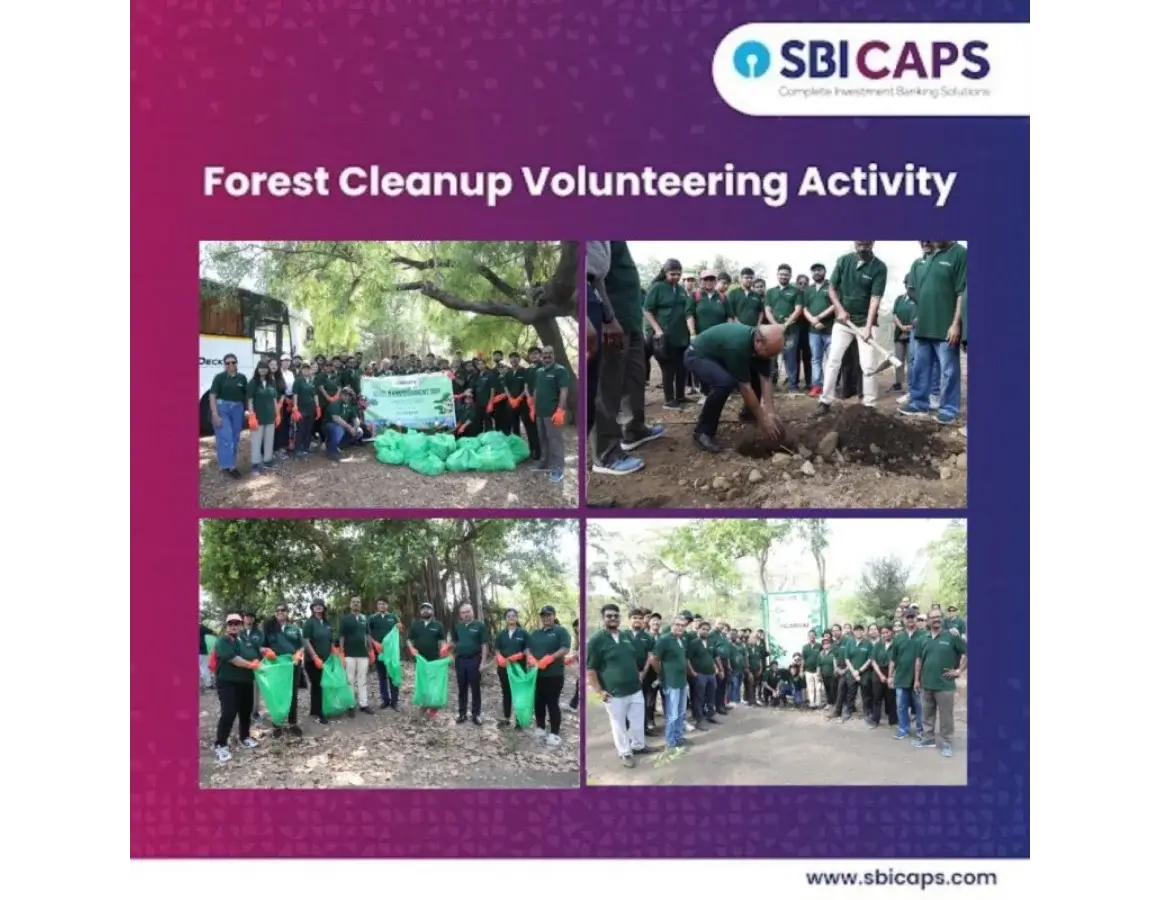

On the occasion of World Environment Day, SBICAPS employee volunteers along with our CSR partner - Nature Forever Society, undertook...

06 Jun 2024

Read more

SBICAPS acted as the Sole Financial Advisor to IAV Urja Services Limited for the successful financial closure of its Project Finance facility for...

06 Jun 2024

Read more

The Ministry of Housing and Urban Affairs (MoHUA) recently held a two-day Chintan Shivir in New Delhi on "Reimagining Urban Governance and...

03 Jun 2024

Read more

Join us as we continue our 'Expert Speak' series with Mr Rajan Gupta - EVP & Group Head (Project Advisory...

17 May 2024

Read more

SBICAPS is proud to be associated with the successful IPO of Aadhar Housing Finance Ltd, backed by Blackstone Private Equity....

15 May 2024

Read more

SBICAPS is happy to partner with the Ministry of Mines

07 May 2024

Read more

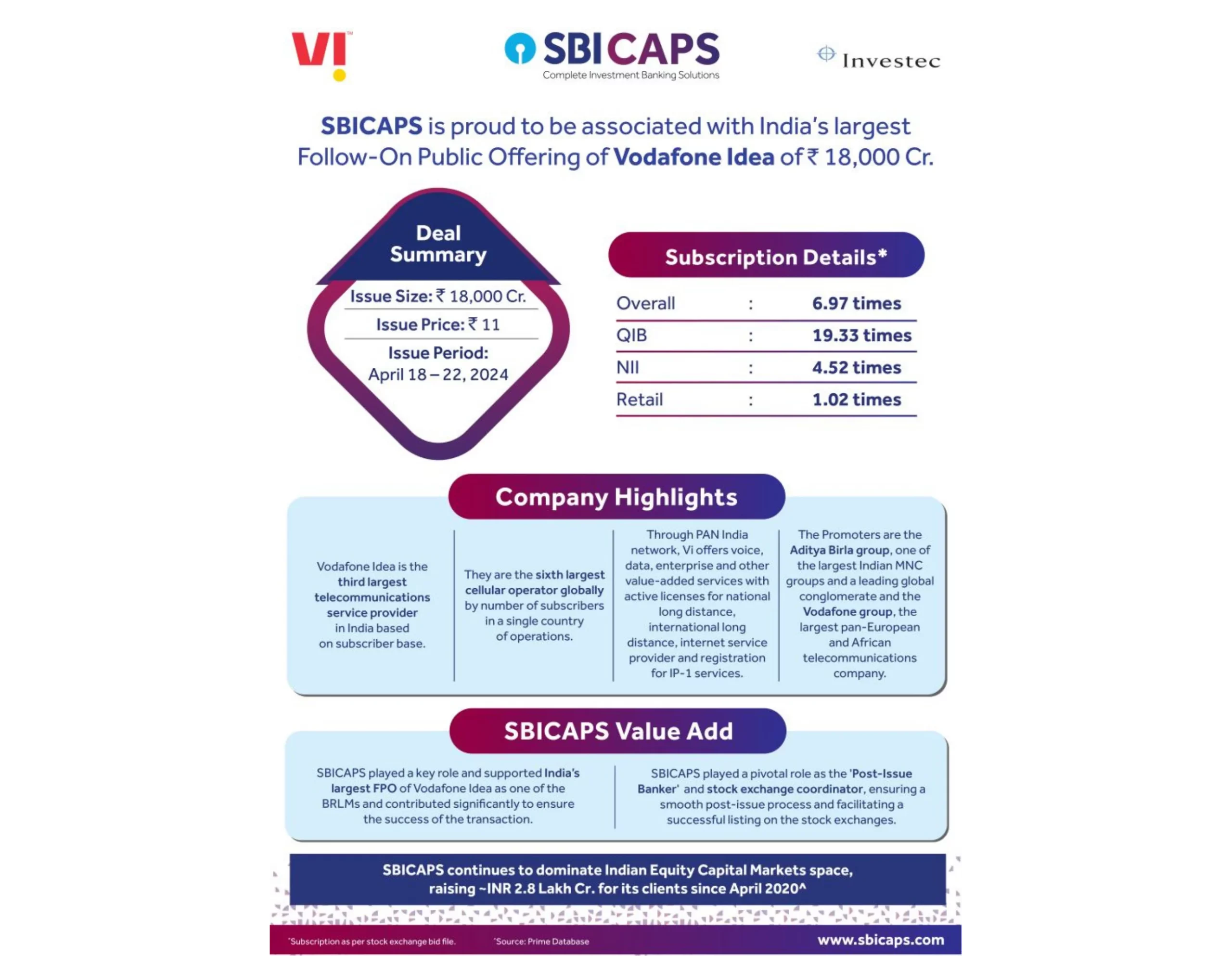

SBICAPS is proud to be associated with India's largest Follow-on Public Offering of Vodafone Idea of ₹18,000 Cr

03 May 2024

Read more

As part of our Corporate Social Responsibility (CSR) programme, SBICAPS in collaboration with Concern India Foundation has donated 4 fully...

26 Apr 2024

Read more

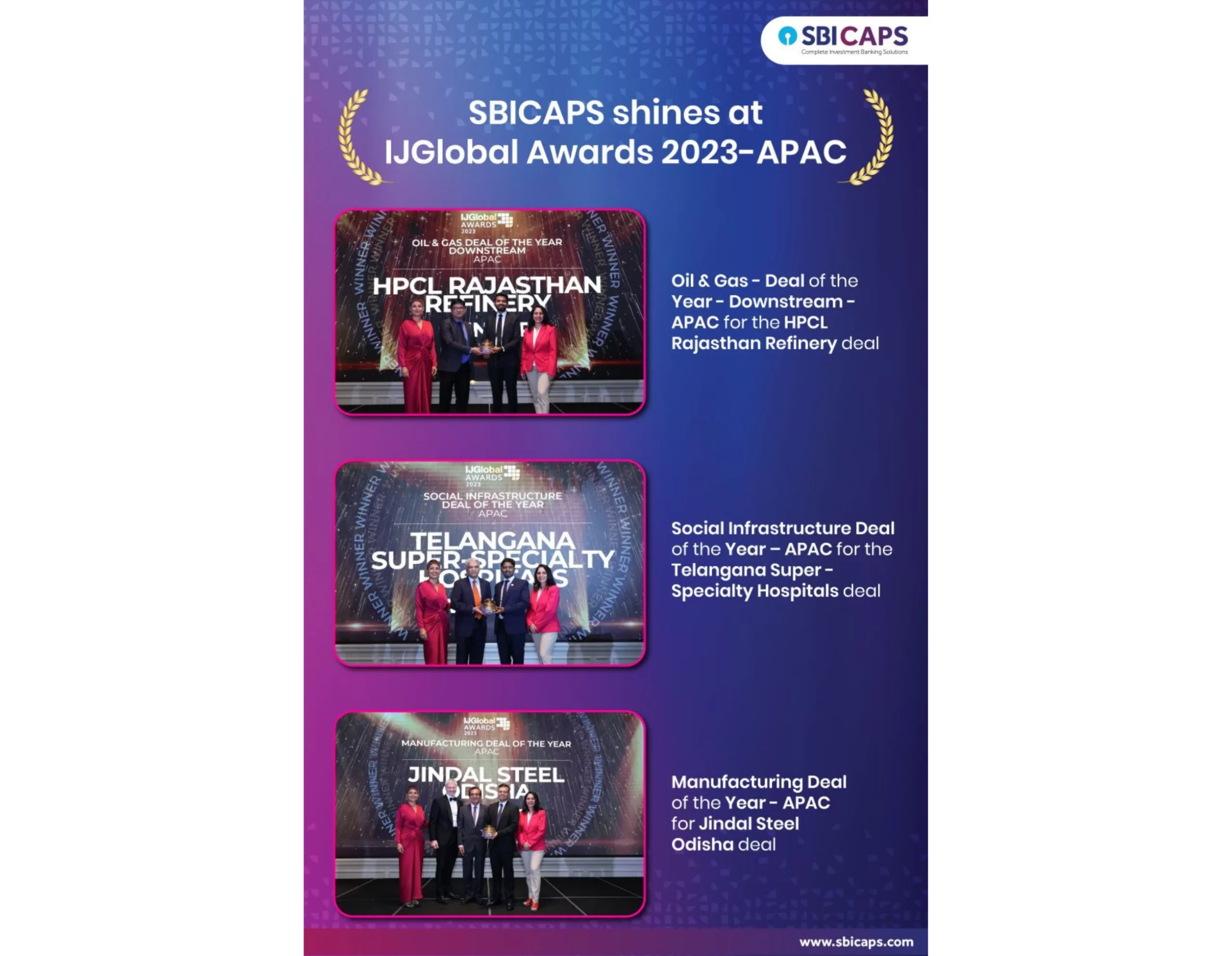

Delighted to win at the prestigious IJGlobal Awards 2023 for the Asia Pacific region conducted in Singapore recently. Here’s to...

25 Apr 2024

Read more

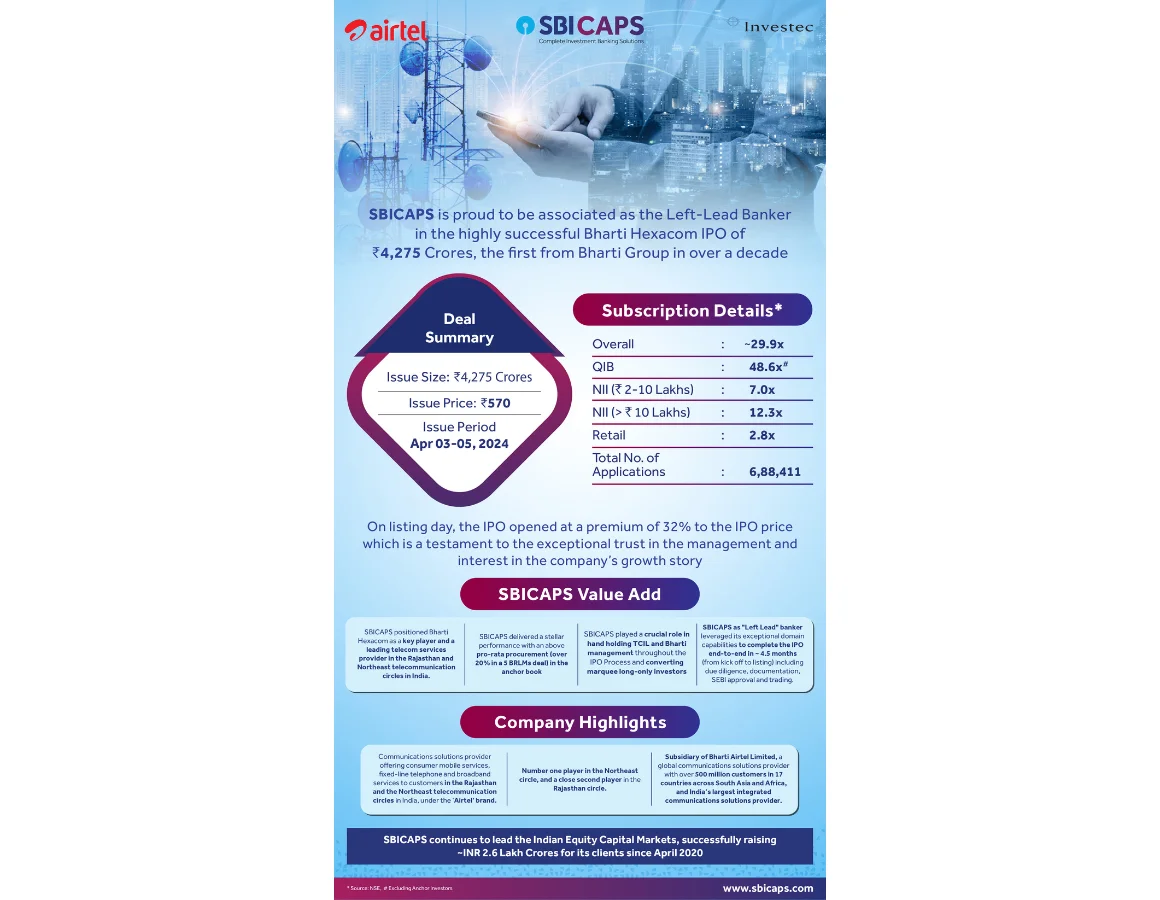

SBICAPS is proud to be associated as the Left-Lead Banker for the blockbuster INR 4,275 crores IPO of Bharti Hexacom...

16 Apr 2024

Read more

Tune into Episode 3 of the ‘SBICAPS Expert Speak’ series packed with career insights and tips for ambitious young professionals...

04 Apr 2024

Read more

In continuation to our ‘SBICAPS Expert Speak’ series, we present the 2nd episode detailing the emerging trends in the Debt...

22 Mar 2024

Read more

SBICAPS is proud to have acted as Left Lead Merchant Banker to NHAI InvIT’s ‘Round 3’ unit issuance - one...

21 Mar 2024

Read more

SBICAPS is thrilled to kickstart its 'Expert Speak' series on LinkedIn. In the first episode of this series, get ready...

15 Mar 2024

Read more

SBICAPS is proud to be the sole Transaction Advisor to Government of Maharashtra for the implementation of Mukhyamantri Saur Krishi...

15 Mar 2024

Read more

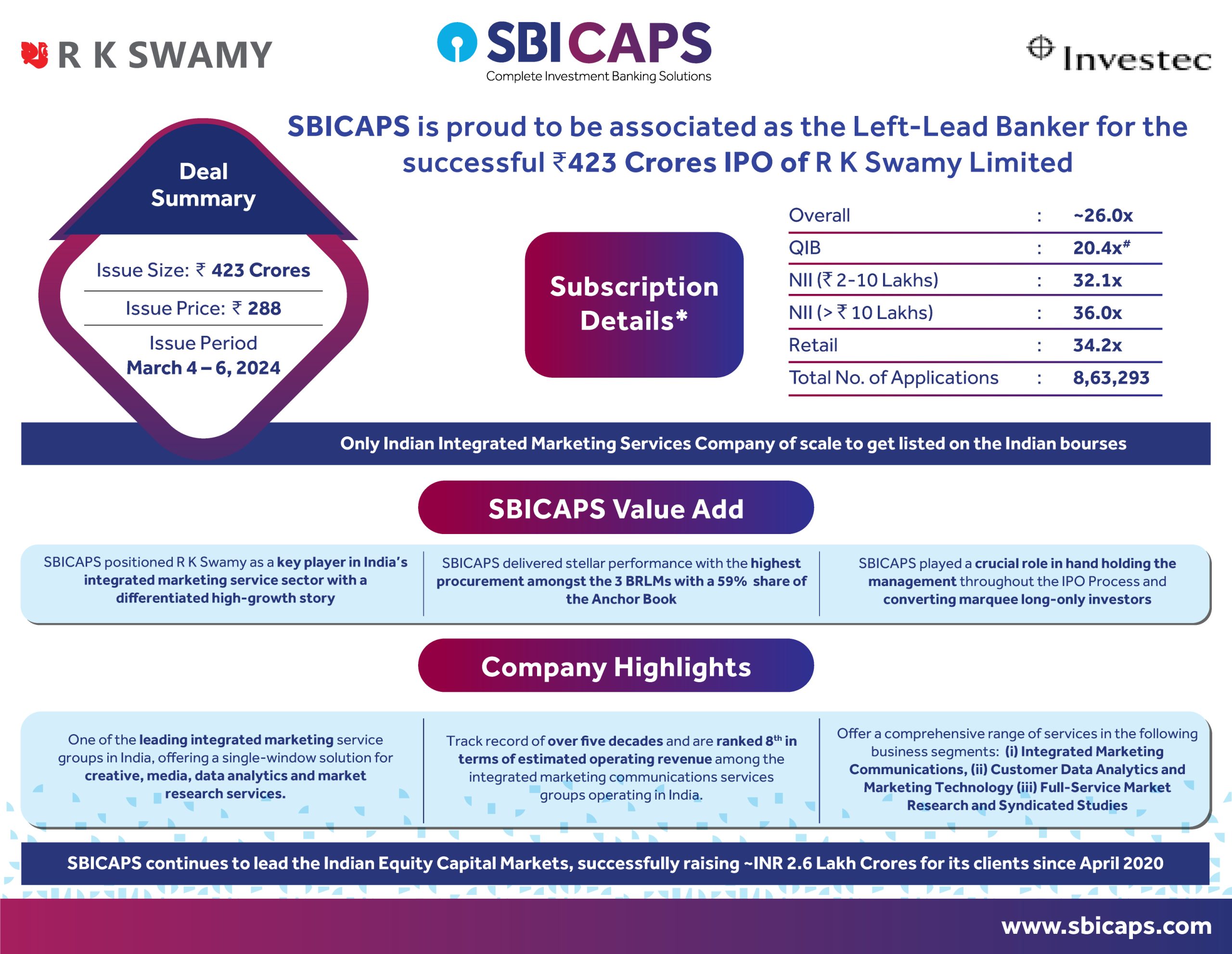

SBICAPS is proud to be associated as the Left-Lead Banker for the successful INR 423 Crores IPO of R K...

12 Mar 2024

Read more

This Women's Day, SBICAPS proudly recognizes the strength, talent, and resilience of our incredible female workforce. Our incredible team of...

08 Mar 2024

Read more

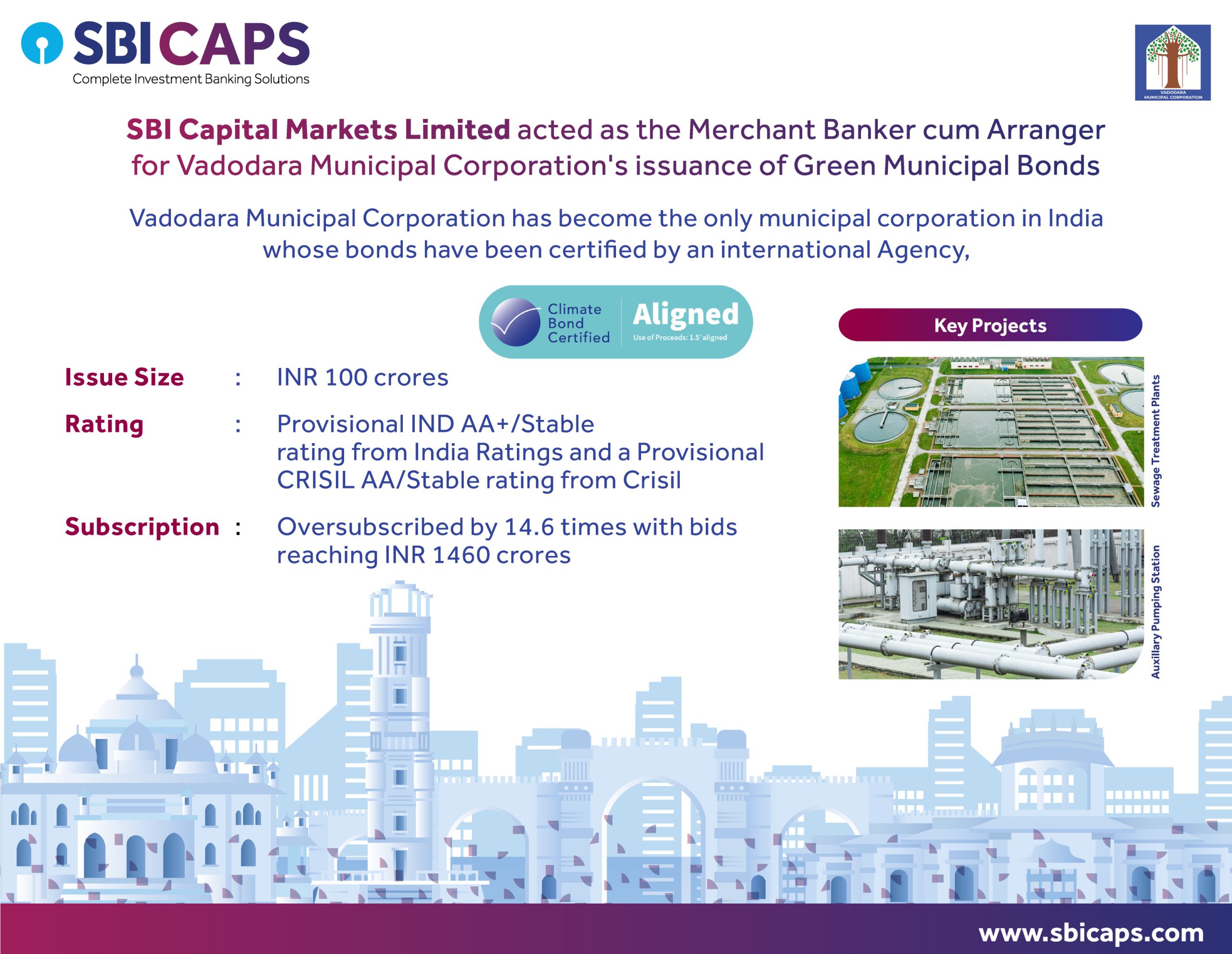

SBICAPS is proud to have played a pivotal role as the Merchant Banker cum Arranger for Vadodara Municipal Corporation's successful...

06 Mar 2024

Read more

SBICAPS is delighted to announce successful completion of ₹4000 Cr Rights Issue of Grasim Industries Limited

06 Mar 2024

Read moreSBICAPS delivers end-to-end fundraising, advisory, and service capabilities for the Automotive and Auto ancillary sector and its subsectors.

SBICAPS has been a trusted advisor and financial partner for all key stakeholders in the Aviation sector, ranging from airports to lenders to regulators.

SBICAPS has consistently been at the forefront of fundraising and providing bespoke advisory services for financial institutions. We have the distinction of acting as lead managers for the majority of Indian banks raising funds, and our dedicated teams have worked on several successful marquee deals for the most reputed names in this sector.

SBICAPS offers cutting-edge advisory services as well as end-to-end investment banking services for players in the Indian Cement sector.

SBICAPS offers corporate advisory and investment banking services for the Chemicals sector, with an emphasis on specialty chemicals.

SBICAPS has worked with various subsectors of the Consumer segment, including manufacturing and retailing of food and beverage, packaged goods, apparel and footwear, accessories, and electronics.

SBICAPS has nurtured strong relationships with the Defence segment, providing advisory and fundraising services.

SBICAPS undertakes strategic advisory projects and transactions of national importance. Our Government Advisory team has extensive expertise in developing comprehensive auction frameworks, managing end-to-end complex bid processes, and assisting public sector entities in formulating and executing asset monetization strategies.

SBICAPS provides award-winning services to help India’s top manufacturing entities access funds and corporate advice. We have taken on the role of lead manager for significant rights issues, including first-of-the-kind issue deals.

SBICAPS is the partner of choice for both corporate and government bodies to address fundraising needs, meet advisory requirements, and add value to transactions.

SBICAPS has deep domain expertise and advisory experience in the Metals and Mining industries. Our service offerings include financial advisory, buy-and-sell-side advisory, project financing and debt syndication, debt restructuring advisory, as well as M&A advisory services. With funds raised for known names in the steel industry, we have received recognition for our work at IFR Asia Awards.

SBICAPS has been at the forefront of successful transactions for premier Oil & Gas businesses. We offer project appraisal, fundraising, financial advisory, valuation, and M&A advisory services, across the industry value chain.

SBICAPS works with the leading businesses in the Petrochemicals sector, helping them meet India’s growing energy needs. We offer the entire gamut of investment banking and advisory services, including capital markets and private equity, project financing and debt syndication, as well as M&A advisory services.

SBICAPS has advised and provided services for varied businesses in the Healthcare segment. This includes biotechnology, diagnostics, life sciences, healthcare services, medical devices, and pharmaceutical businesses.

SBICAPS offers end-to-end investment banking services for fundraising and M&A for businesses in the Port sector. We leverage our strong relationships with multilateral agencies, international financial institutions, central and state governments, PSUs, private sector corporates, and banks to derive maximum value for our clients.

SBICAPS provides strategic advice and access to long-term sources of finance for key players in the Power sector. This is in keeping with our commitment to the country’s progress. We have handled several mandates for reputed organisations and various state electricity boards.

As a trusted advisor for infrastructure projects, SBICAPS has helped Railways access the funds needed for large-scale projects. We have provided Financial Advisory, Debt Syndication, Fundraising, and M&A assistance in the Railway sector.

SBICAPS brings unparalleled value accretive capabilities in the real estate sector and has strong relationships with investors, lenders, and developers. We provide end-to-end solutions in deal structuring across the office, residential, retail, and hospitality segments.

SBICAPS offers comprehensive investment banking services for fundraising in the renewable energy sector. Harnessing our relationships with various financial institutions, corporate houses, and government bodies, we have concluded numerous transactions for wind and solar energy projects, including arranging specialised lines of credit.

Leading names in the retail segment trust SBICAPS to guide them on matters of strategic importance. Apart from online retailers, we work with some of the most recognised brands in the segments of jewellery and fashion.

SBICAPS has advised on capital raising and growth strategy, and provides all-encompassing investment banking services for fundraising and M&A in the roads sector. As financial advisors and mandated lead arrangers, we have worked closely with enterprises in this segment, and on both national highway and state road highway projects.

SBICAPS has extensive experience in advising Service businesses and undertaking deals for our entrepreneurial clients.

SBICAPS has deep experience in the technology sector, which we leverage to deliver value to clients through Venture Capital and Private Equity Advisory, and M&A advisory.

SBICAPS offers debt syndication and business advisory services as well as restructuring services for companies in the Telecom sector.

We partner with public institutions and authorities on key initiatives that drive the country’s holistic economic progress, while deploying our resources to boost sustainable development and create opportunities for all sections of society.

We push the boundaries of the financial services sector, with many ‘firsts’ to our credit. From offering innovative solutions to clients to assisting in the reconstruction of India’s financial landscape, we are at the helm, rethinking possibilities.

SBICAPS offers you best-in-class training, competitive benefits, and unlimited exposure to industry expertise.