Driving Automotive Development

SBICAPS delivers end-to-end fundraising, advisory, and service capabilities for the Automotive and Auto ancillary sector and its subsectors.

SBI Capital Markets enables clients to meet their strategic and business objectives through its complete bouquet of investment banking and corporate advisory services.

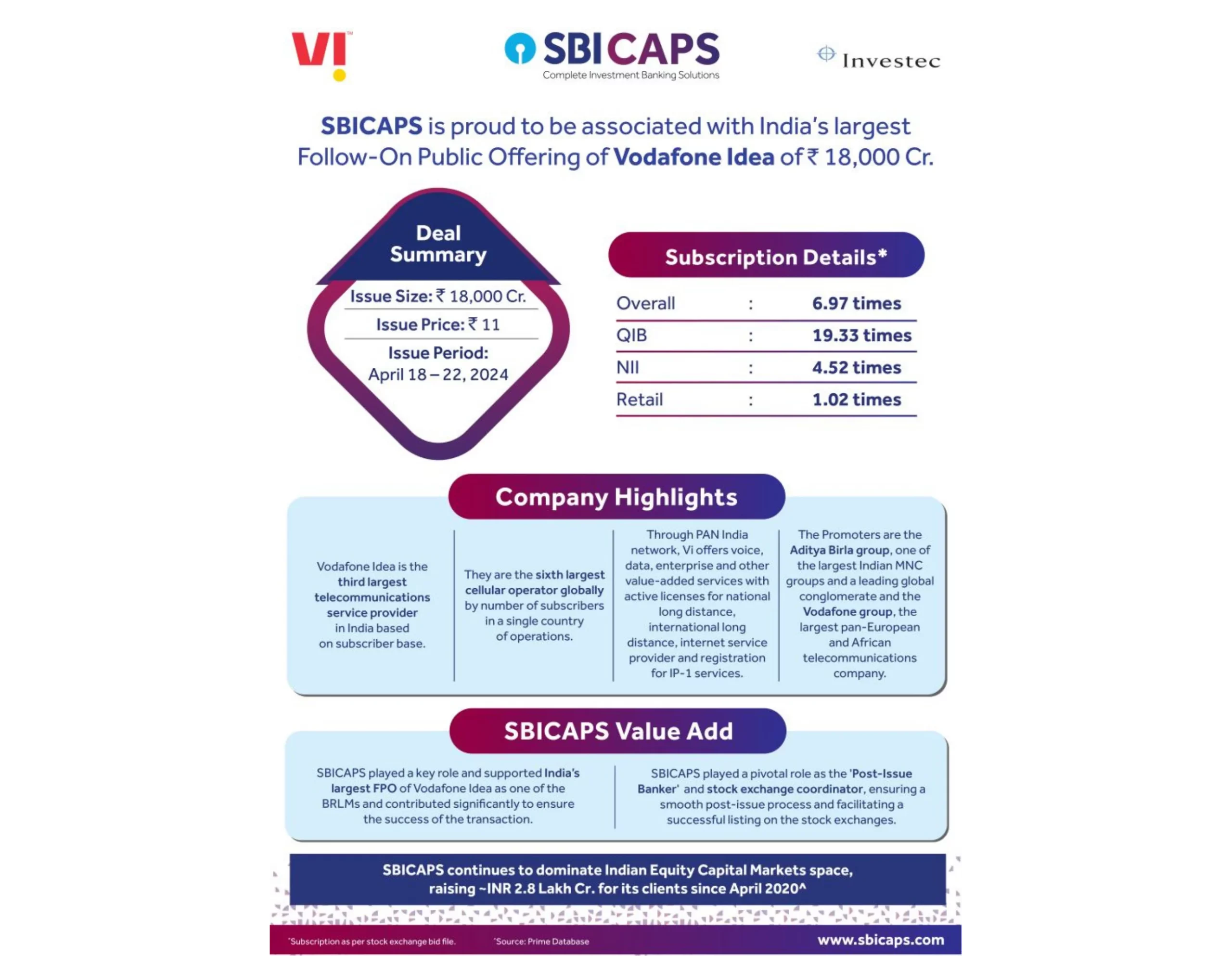

SBICAPS is proud to be associated with India's largest Follow-on Public Offering of Vodafone Idea of ₹18,000 Cr

03 May 2024

Read more

As part of our Corporate Social Responsibility (CSR) programme, SBICAPS in collaboration with Concern India Foundation has donated 4 fully...

26 Apr 2024

Read more

Delighted to win at the prestigious IJGlobal Awards 2023 for the Asia Pacific region conducted in Singapore recently. Here’s to...

25 Apr 2024

Read more

SBICAPS is proud to be associated as the Left-Lead Banker for the blockbuster INR 4,275 crores IPO of Bharti Hexacom...

16 Apr 2024

Read more

Tune into Episode 3 of the ‘SBICAPS Expert Speak’ series packed with career insights and tips for ambitious young professionals...

04 Apr 2024

Read more

In continuation to our ‘SBICAPS Expert Speak’ series, we present the 2nd episode detailing the emerging trends in the Debt...

22 Mar 2024

Read more

SBICAPS is proud to have acted as Left Lead Merchant Banker to NHAI InvIT’s ‘Round 3’ unit issuance - one...

21 Mar 2024

Read more

SBICAPS is thrilled to kickstart its 'Expert Speak' series on LinkedIn. In the first episode of this series, get ready...

15 Mar 2024

Read more

SBICAPS is proud to be the sole Transaction Advisor to Government of Maharashtra for the implementation of Mukhyamantri Saur Krishi...

15 Mar 2024

Read more

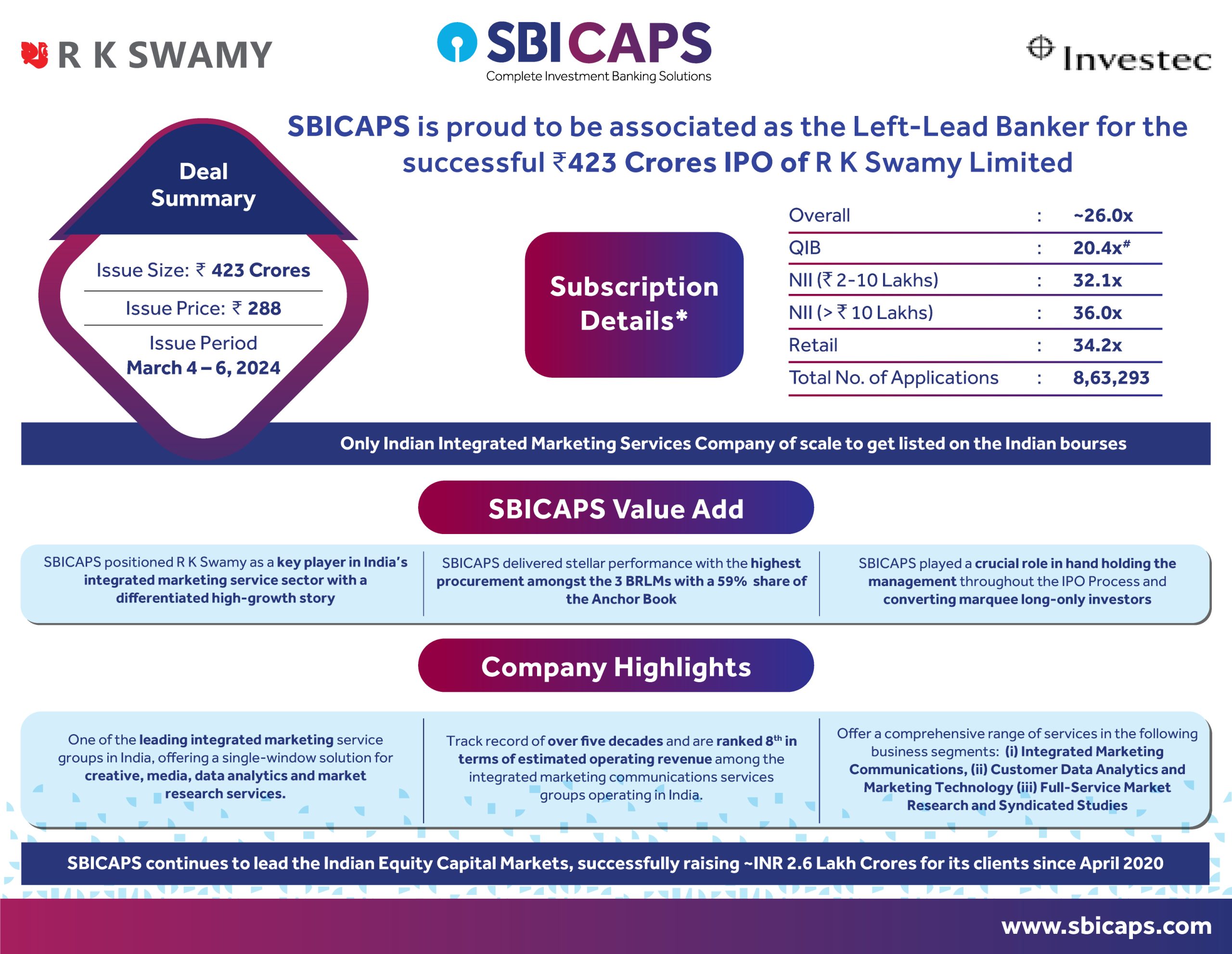

SBICAPS is proud to be associated as the Left-Lead Banker for the successful INR 423 Crores IPO of R K...

12 Mar 2024

Read more

This Women's Day, SBICAPS proudly recognizes the strength, talent, and resilience of our incredible female workforce. Our incredible team of...

08 Mar 2024

Read more

SBICAPS is proud to have played a pivotal role as the Merchant Banker cum Arranger for Vadodara Municipal Corporation's successful...

06 Mar 2024

Read more

SBICAPS is delighted to announce successful completion of ₹4000 Cr Rights Issue of Grasim Industries Limited

06 Mar 2024

Read more

As a part of SBICAPS' CSR initiatives and continued focus on education, we have partnered with the Maharashtra Government's CSR...

28 Feb 2024

Read more

SBICAPS is proud to be associated with the successful IPO of Entero Healthcare Solutions.

23 Feb 2024

Read more

We are thrilled to announce our role as the sole-merchant banker cum arranger in the successful listing ceremony of Green...

15 Feb 2024

Read more

At SBICAPS we believe in fostering not just professional growth but also the overall well-being of our employees. As part...

15 Feb 2024

Read more

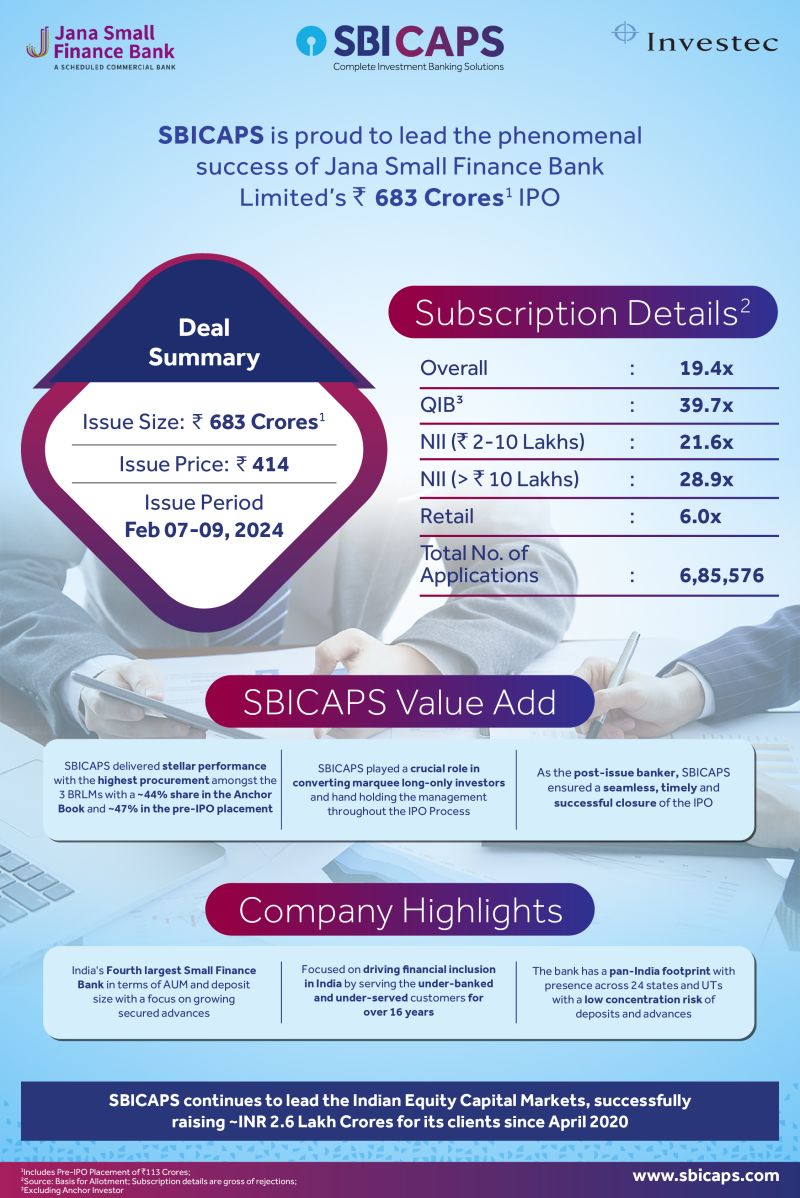

SBICAPS is proud to lead the successful IPO of Jana Small Finance Bank Ltd, 4th largest small finance bank by...

15 Feb 2024

Read more

SBI Capital Markets welcomes Shri Virendra Bansal as new Managing Director & CEO.

15 Feb 2024

Read more

We are happy to share this achievement, a testament to the dedication and expertise of our team. Here's to many...

08 Feb 2024

Read more

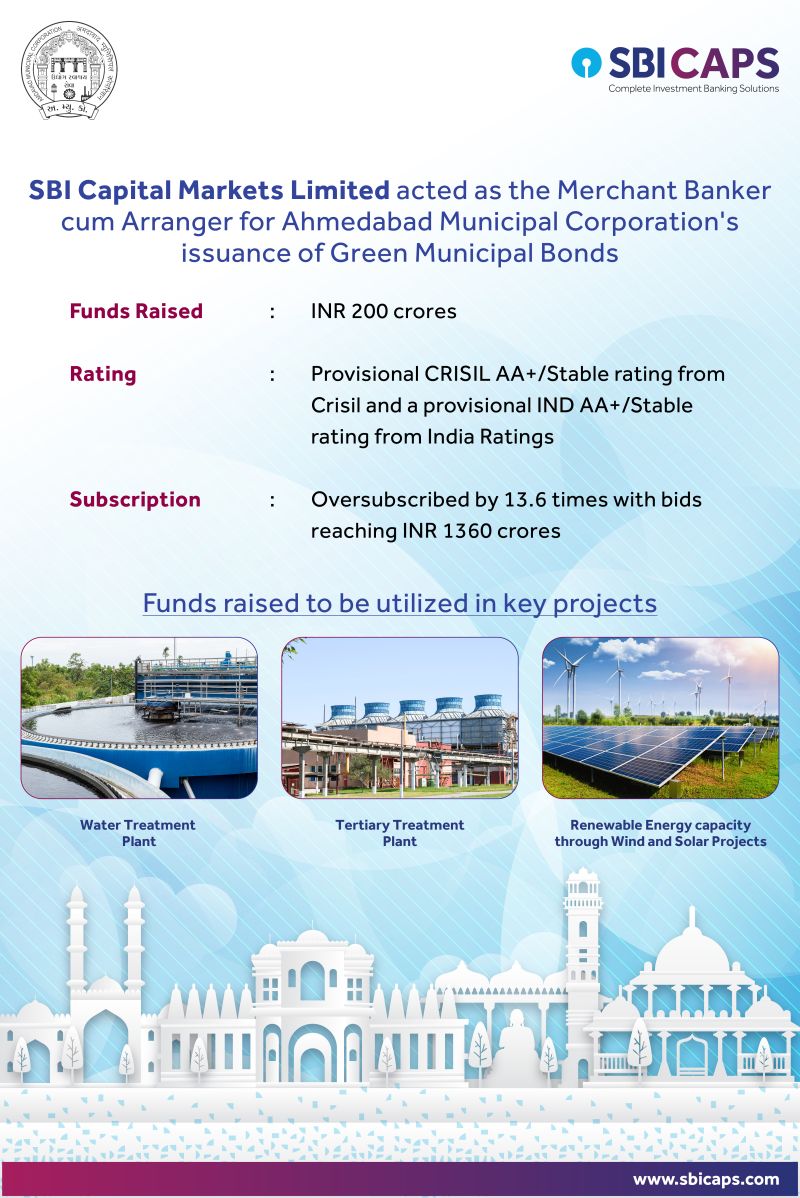

SBI Capital Markets Limited takes immense pride in serving as the Merchant Banker cum Arranger for Ahmedabad Municipal Corporation's (AMC)...

08 Feb 2024

Read more

Project Finance International (PFI) India Clean Energy Financing Summit 2024 was organised on January 30th in Mumbai. The event comprised...

03 Feb 2024

Read more

We are happy to share this achievement, a testament to the dedication and expertise of our team. Here's to many...

03 Feb 2024

Read more

SBICAPS' journey over the years has been inextricably linked to the progress and growth of India and its economy. Nation...

29 Jan 2024

Read more

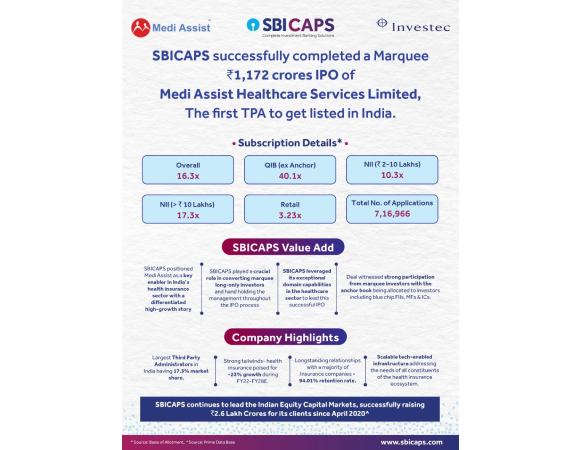

SBICAPS is proud to be associated with the successful IPO of Medi Assist Healthcare Services Limited.

24 Jan 2024

Read more

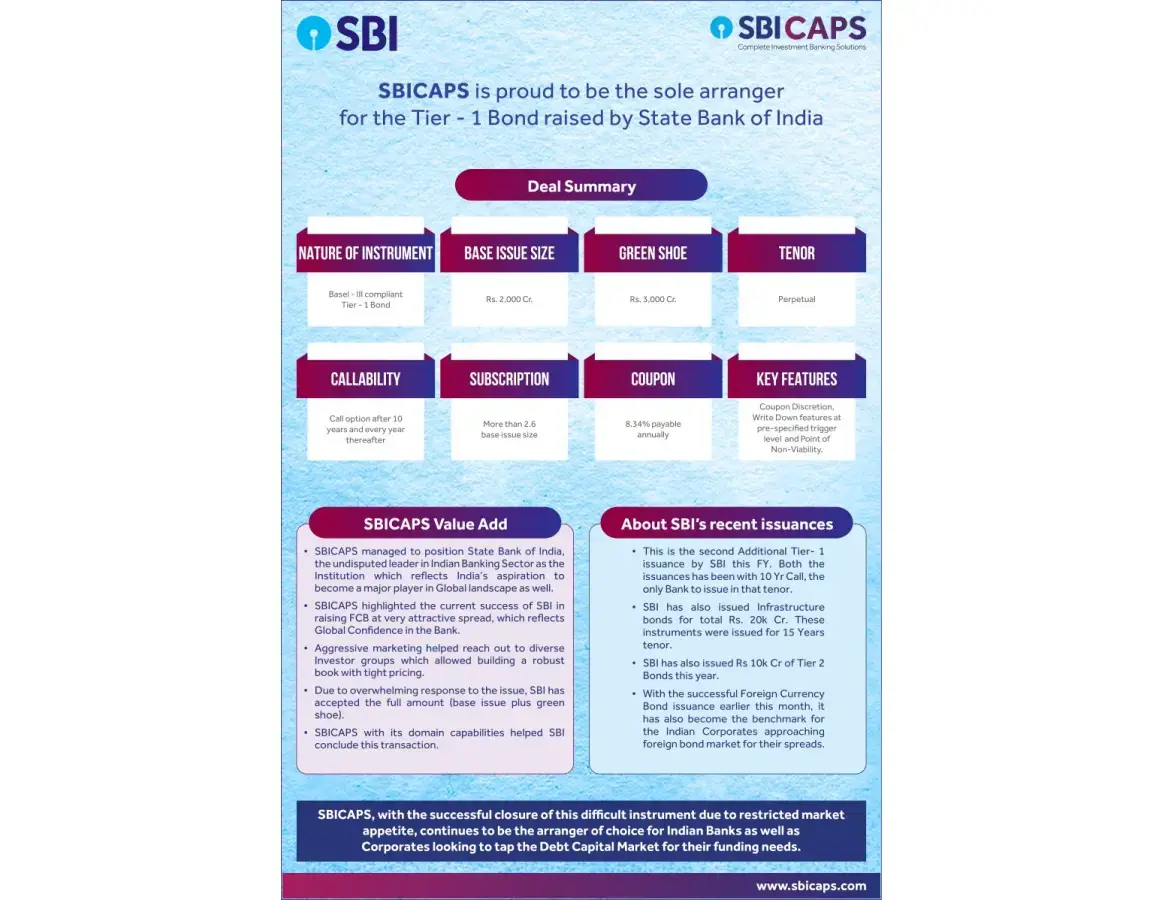

SBICAPS is proud to be the sole arranger for the Tier-1 bond raised by State Bank of India!

19 Jan 2024

Read more

SBICAPS is proud to be associated with the successful IPO of Jyoti CNC Automation Limited.

18 Jan 2024

Read more

SBICAPS was proud to be associated with the “EV Investment & Finance Show 2024” organised on 17th January in New...

18 Jan 2024

Read more

As part of our CSR initiatives, SBICAPS has been supporting clean-up efforts at Mumbai's Mahim and Dadar seafronts in association...

16 Jan 2024

Read more

BICAPS is proud to be associated with Guwahati Municipal Corporation (GMC) and has been appointed as sole Transaction Advisor and...

10 Jan 2024

Read more

SBICAPS has successfully concluded the sanctions for Rs. 10,000 crores of Construction Finance Line for SJVN Green Energy Limited (SGEL,...

10 Jan 2024

Read more

We decked up the SBICAPS Corporate Office for a combined celebration of Christmas and New Year along with our families....

03 Jan 2024

Read more

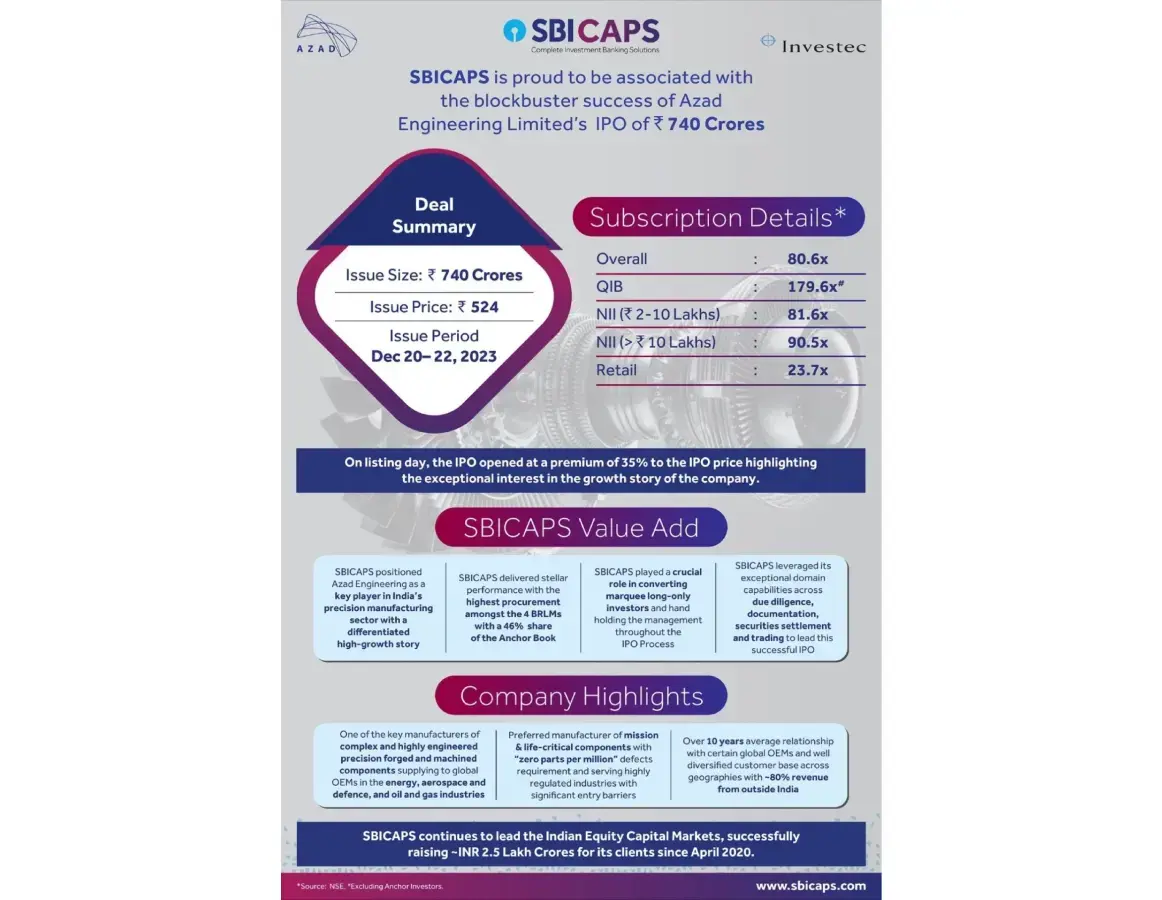

SBICAPS is proud to be associated with the blockbuster success of Azad Engineering Limited’s IPO of INR 740 Crores. The...

03 Jan 2024

Read more

We wish all our clients and stakeholders a very HAPPY NEW YEAR 2024 and look forward to your continued support.

03 Jan 2024

Read more

Partners in Progress: Empowering Client Dreams with SBICAPS

03 Jan 2024

Read more

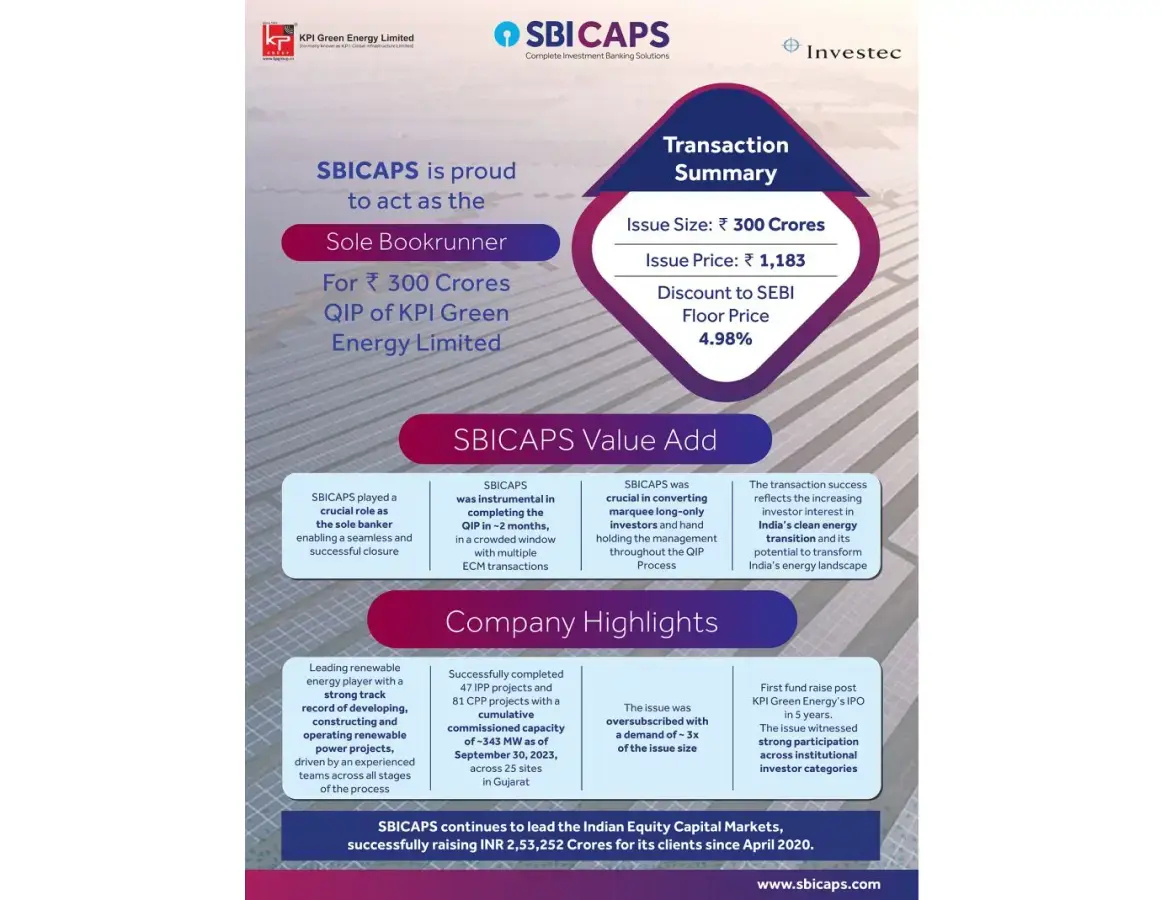

SBICAPS is proud to act as the Sole Bookrunner for INR 300 Crores QIP of KPI Green Energy, one of...

28 Dec 2023

Read more

SBICAPS is proud to partner with HPCL in achieving remarkable strides in Environmental, Social, and Governance (ESG) ratings in the...

27 Dec 2023

Read more

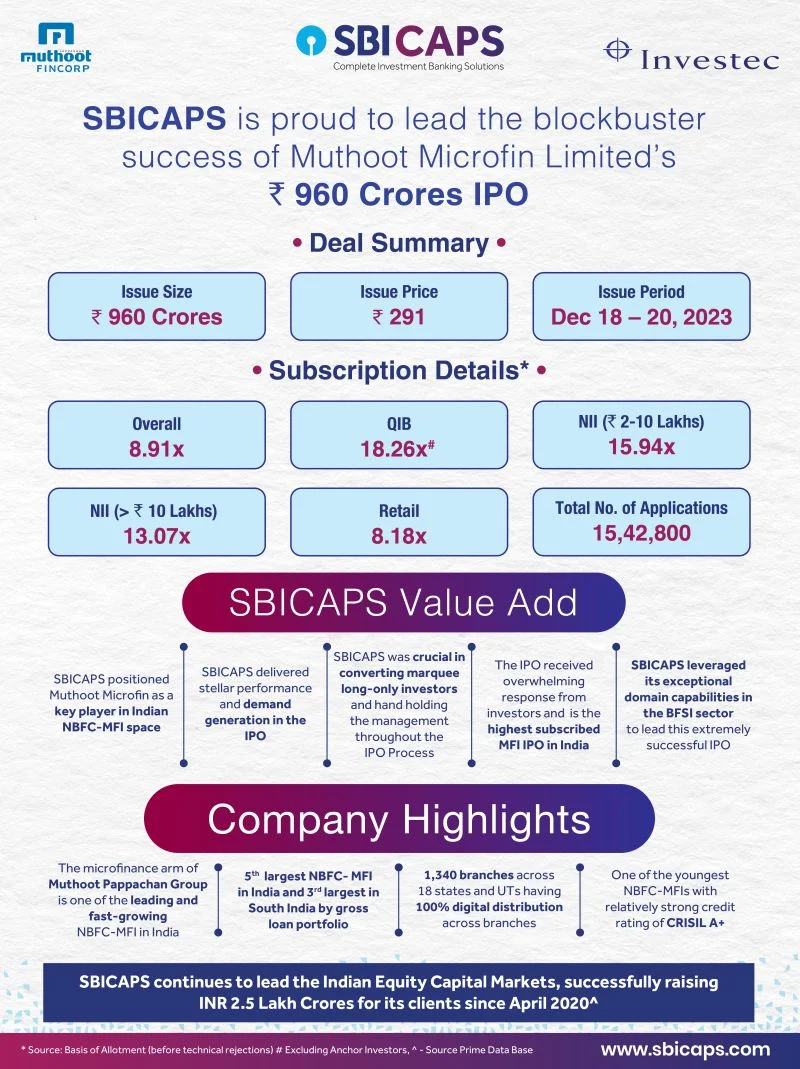

Delighted to announce that SBICAPS has played a pivotal role in the successful closure of the Muthoot Microfin IPO. A...

26 Dec 2023

Read more

Our annual Santa drive brought holiday magic to SBICAPS, while Secret Santa kept the surprises rolling. Wishing everyone a festive...

23 Dec 2023

Read more

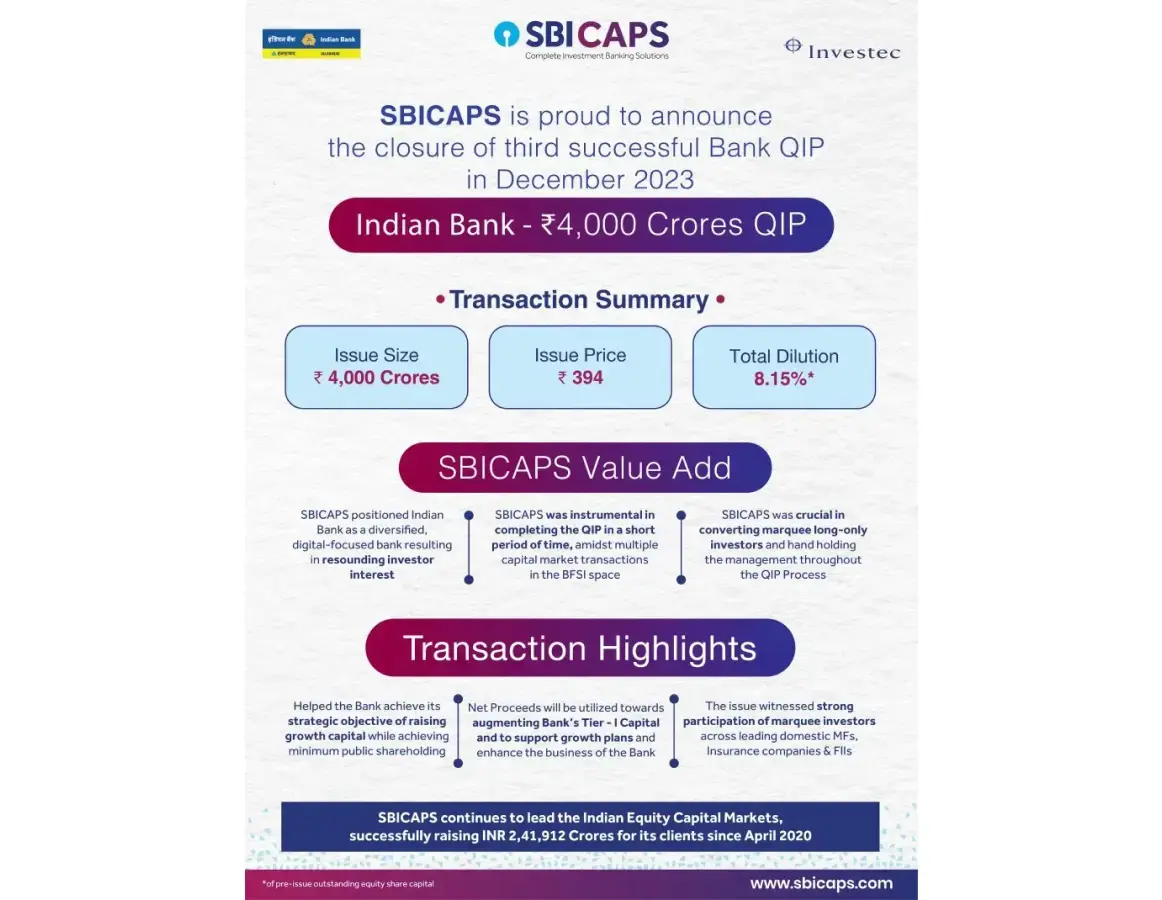

SBICAPS is delighted to announce the successful closure of Rs 4,000 Crore QIP of Indian Bank - India’s seventh largest...

21 Dec 2023

Read more

As part of its CSR programme, SBICAPS has been working with Catalysts For Social Action (CSA) - a registered not-for-profit...

19 Dec 2023

Read more

The 26th edition of the Bengaluru Tech Summit (BTS 2023) organized by the Dept. of Electronics, IT, Bt and S&T,...

13 Dec 2023

Read more

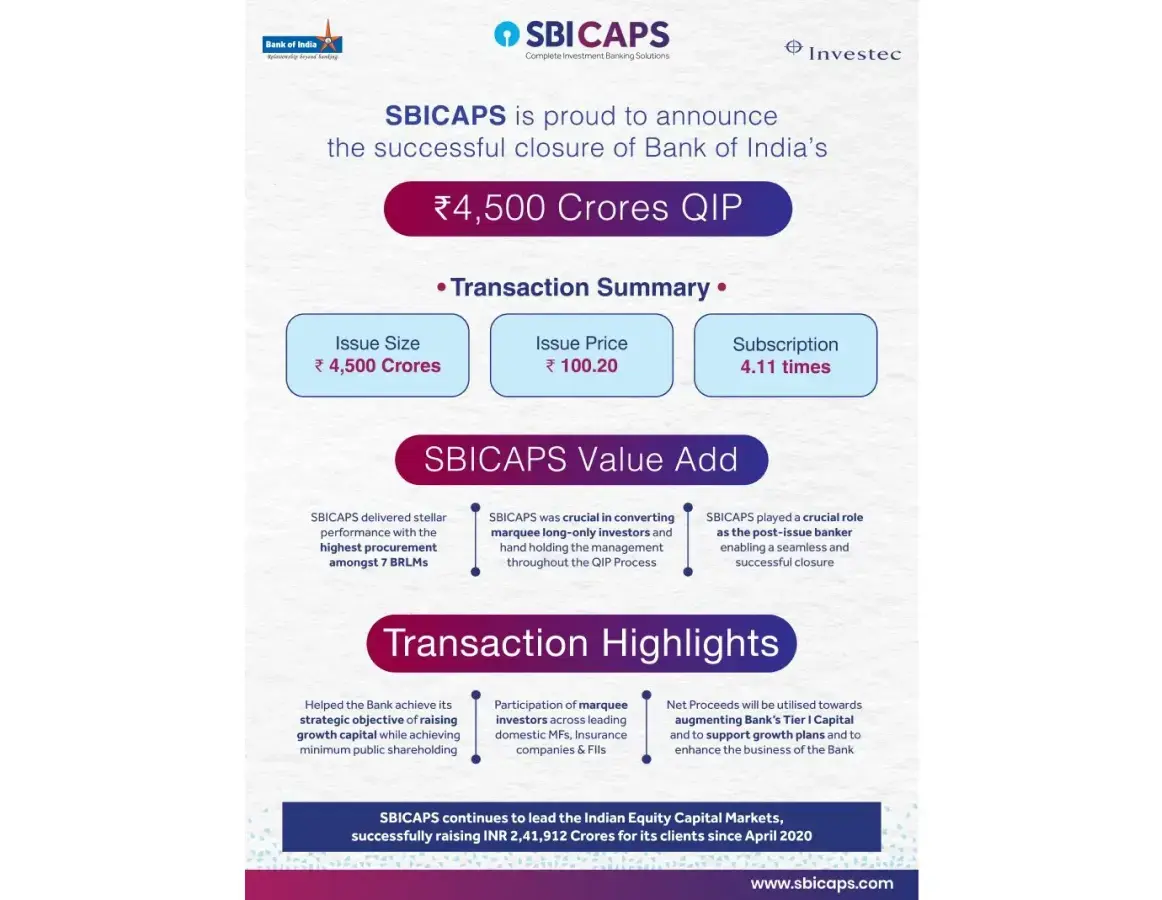

SBICAPS is delighted to announce the successful closure of Rs 4,500 Crore QIP of Bank of India - India’s sixth...

13 Dec 2023

Read more

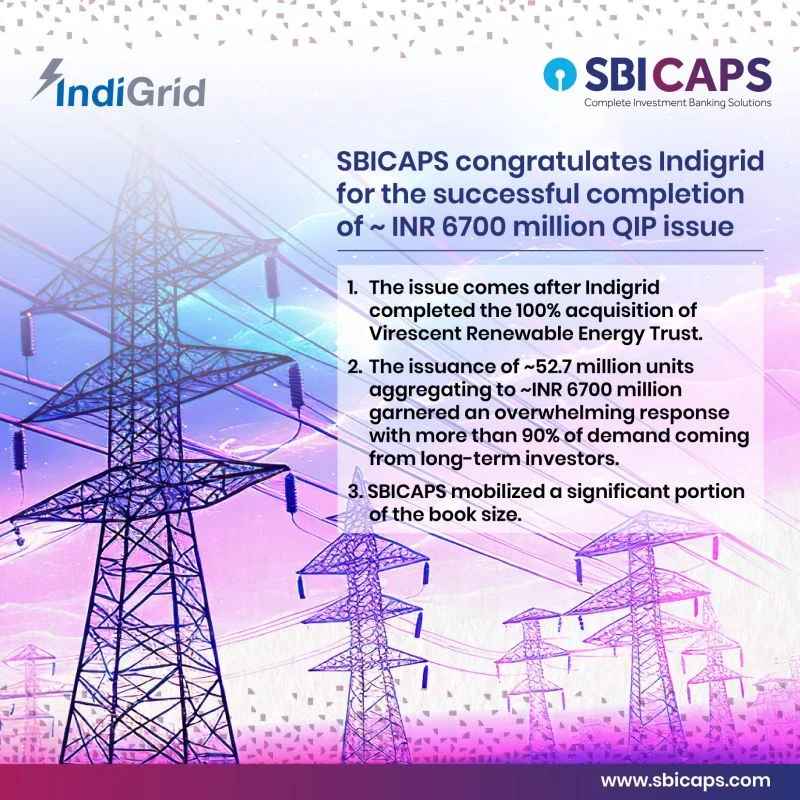

SBICAPS is thrilled to share the announcement made by Indigrid about the successful completion of ~6700 million of Qualified Institutional...

12 Dec 2023

Read more

At SBICAPS, our commitment to the well-being of our employees remains steadfast and paramount. In line with industry best practices,...

07 Dec 2023

Read more

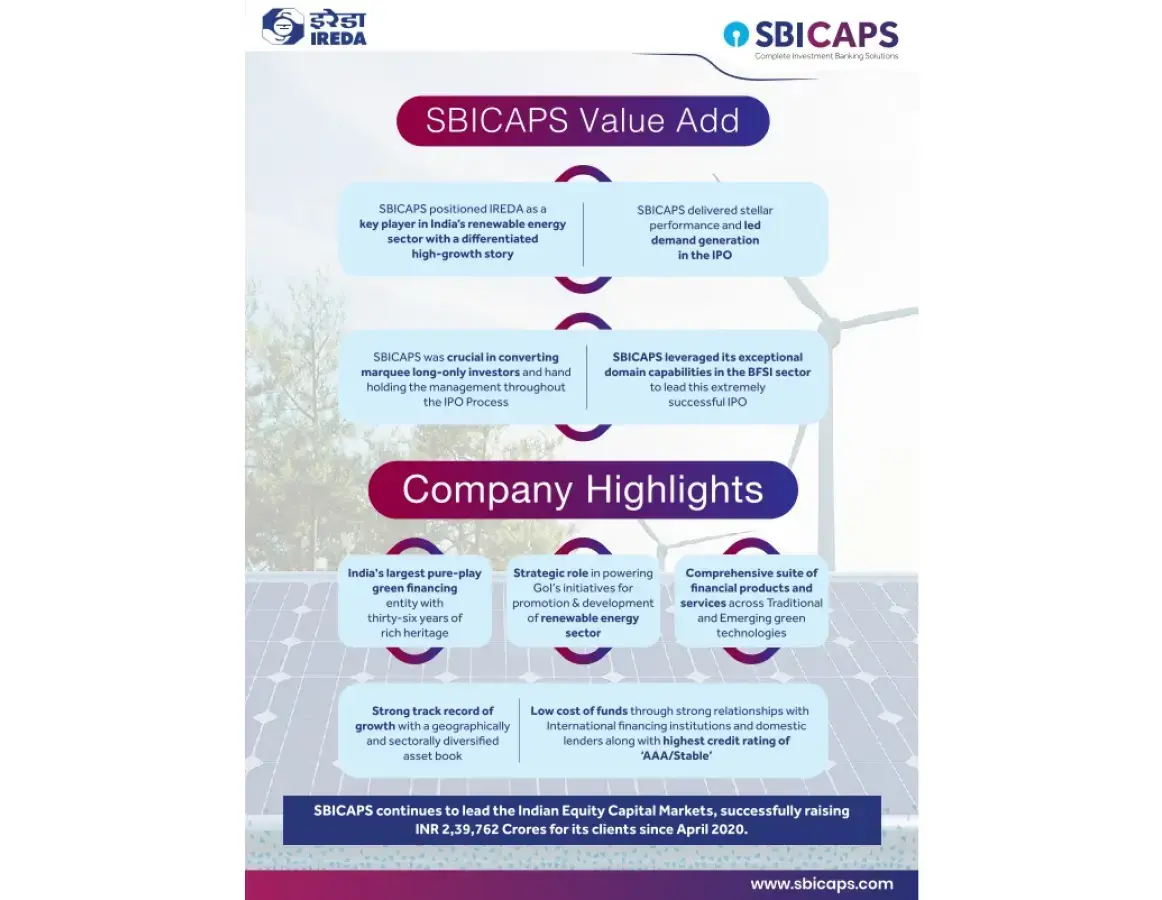

SBICAPS is proud to be a key partner in the blockbuster IPO of IREDA Ltd. , India’s largest pure-play green...

05 Dec 2023

Read more

We were delighted to participate in the India Loan Market Conference, that brought together industry leaders to discuss the latest...

28 Nov 2023

Read more

The Central Vigilance Commission observes “Vigilance Awareness Week” every year in the week in which the birthday of Sardar Vallabhbhai...

30 Oct 2023

Read more

As part of our CSR initiatives, SBICAPS has been supporting the Society of Community Health Oriented Operational Links (SCHOOL) -...

17 Oct 2023

Read more

Power sector in India in the FY 2023 has been a happening year in many ways. Power generation has grown...

03 Oct 2023

Read more

SBI Capital Markets is proud to be associated with the marquee IPO of JSW Infrastructure Limited.

03 Oct 2023

Read more

MUMBAI, Sept 27 (Reuters) - Indian lenders are rushing to raise funds via longer term infrastructure bonds amid an increase...

27 Sep 2023

Read more

Apply Now: https://bit.ly/joinSBICAPS

28 Jul 2021

Read more

SBICAPS delivers end-to-end fundraising, advisory, and service capabilities for the Automotive and Auto ancillary sector and its subsectors.

SBICAPS has been a trusted advisor and financial partner for all key stakeholders in the Aviation sector, ranging from airports to lenders to regulators.

SBICAPS has consistently been at the forefront of fundraising and providing bespoke advisory services for financial institutions. We have the distinction of acting as lead managers for the majority of Indian banks raising funds, and our dedicated teams have worked on several successful marquee deals for the most reputed names in this sector.

SBICAPS offers cutting-edge advisory services as well as end-to-end investment banking services for players in the Indian Cement sector.

SBICAPS offers corporate advisory and investment banking services for the Chemicals sector, with an emphasis on specialty chemicals.

SBICAPS has worked with various subsectors of the Consumer segment, including manufacturing and retailing of food and beverage, packaged goods, apparel and footwear, accessories, and electronics.

SBICAPS has nurtured strong relationships with the Defence segment, providing advisory and fundraising services.

SBICAPS undertakes strategic advisory projects and transactions of national importance. Our Government Advisory team has extensive expertise in developing comprehensive auction frameworks, managing end-to-end complex bid processes, and assisting public sector entities in formulating and executing asset monetization strategies.

SBICAPS provides award-winning services to help India’s top manufacturing entities access funds and corporate advice. We have taken on the role of lead manager for significant rights issues, including first-of-the-kind issue deals.

SBICAPS is the partner of choice for both corporate and government bodies to address fundraising needs, meet advisory requirements, and add value to transactions.

SBICAPS has deep domain expertise and advisory experience in the Metals and Mining industries. Our service offerings include financial advisory, buy-and-sell-side advisory, project financing and debt syndication, debt restructuring advisory, as well as M&A advisory services. With funds raised for known names in the steel industry, we have received recognition for our work at IFR Asia Awards.

SBICAPS has been at the forefront of successful transactions for premier Oil & Gas businesses. We offer project appraisal, fundraising, financial advisory, valuation, and M&A advisory services, across the industry value chain.

SBICAPS works with the leading businesses in the Petrochemicals sector, helping them meet India’s growing energy needs. We offer the entire gamut of investment banking and advisory services, including capital markets and private equity, project financing and debt syndication, as well as M&A advisory services.

SBICAPS has advised and provided services for varied businesses in the Healthcare segment. This includes biotechnology, diagnostics, life sciences, healthcare services, medical devices, and pharmaceutical businesses.

SBICAPS offers end-to-end investment banking services for fundraising and M&A for businesses in the Port sector. We leverage our strong relationships with multilateral agencies, international financial institutions, central and state governments, PSUs, private sector corporates, and banks to derive maximum value for our clients.

SBICAPS provides strategic advice and access to long-term sources of finance for key players in the Power sector. This is in keeping with our commitment to the country’s progress. We have handled several mandates for reputed organisations and various state electricity boards.

As a trusted advisor for infrastructure projects, SBICAPS has helped Railways access the funds needed for large-scale projects. We have provided Financial Advisory, Debt Syndication, Fundraising, and M&A assistance in the Railway sector.

SBICAPS brings unparalleled value accretive capabilities in the real estate sector and has strong relationships with investors, lenders, and developers. We provide end-to-end solutions in deal structuring across the office, residential, retail, and hospitality segments.

SBICAPS offers comprehensive investment banking services for fundraising in the renewable energy sector. Harnessing our relationships with various financial institutions, corporate houses, and government bodies, we have concluded numerous transactions for wind and solar energy projects, including arranging specialised lines of credit.

Leading names in the retail segment trust SBICAPS to guide them on matters of strategic importance. Apart from online retailers, we work with some of the most recognised brands in the segments of jewellery and fashion.

SBICAPS has advised on capital raising and growth strategy, and provides all-encompassing investment banking services for fundraising and M&A in the roads sector. As financial advisors and mandated lead arrangers, we have worked closely with enterprises in this segment, and on both national highway and state road highway projects.

SBICAPS has extensive experience in advising Service businesses and undertaking deals for our entrepreneurial clients.

SBICAPS has deep experience in the technology sector, which we leverage to deliver value to clients through Venture Capital and Private Equity Advisory, and M&A advisory.

SBICAPS offers debt syndication and business advisory services as well as restructuring services for companies in the Telecom sector.

We partner with public institutions and authorities on key initiatives that drive the country’s holistic economic progress, while deploying our resources to boost sustainable development and create opportunities for all sections of society.

We push the boundaries of the financial services sector, with many ‘firsts’ to our credit. From offering innovative solutions to clients to assisting in the reconstruction of India’s financial landscape, we are at the helm, rethinking possibilities.

SBICAPS offers you best-in-class training, competitive benefits, and unlimited exposure to industry expertise.